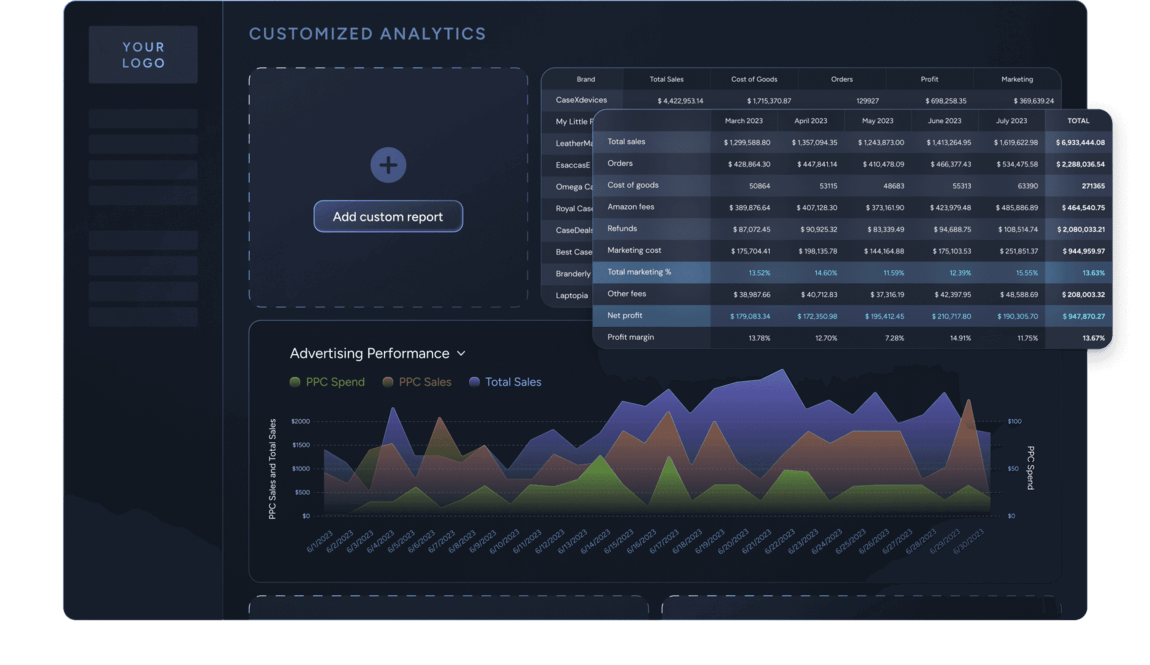

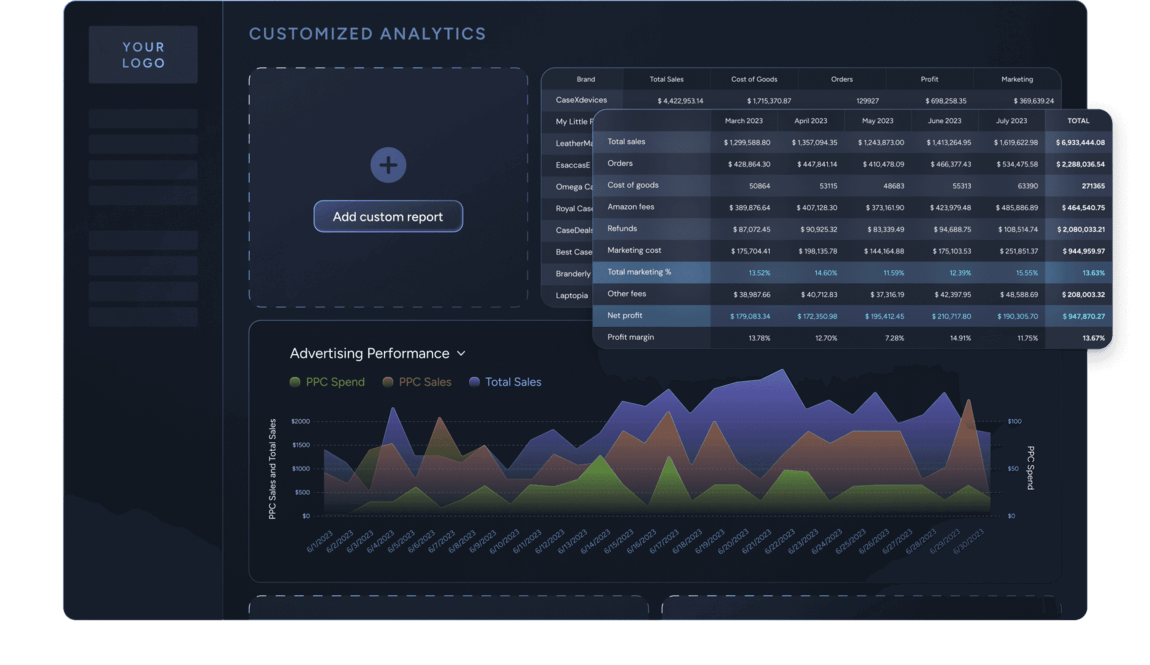

Customizableanalytics ecosystem for Amazon sellers

Discover real reasons why your Amazon business is growing or declining with our tools.

developer council

partner network

Automated reports that help you empower your Amazon strategy, decisions, and time.

Reports that every Amazon business needs daily

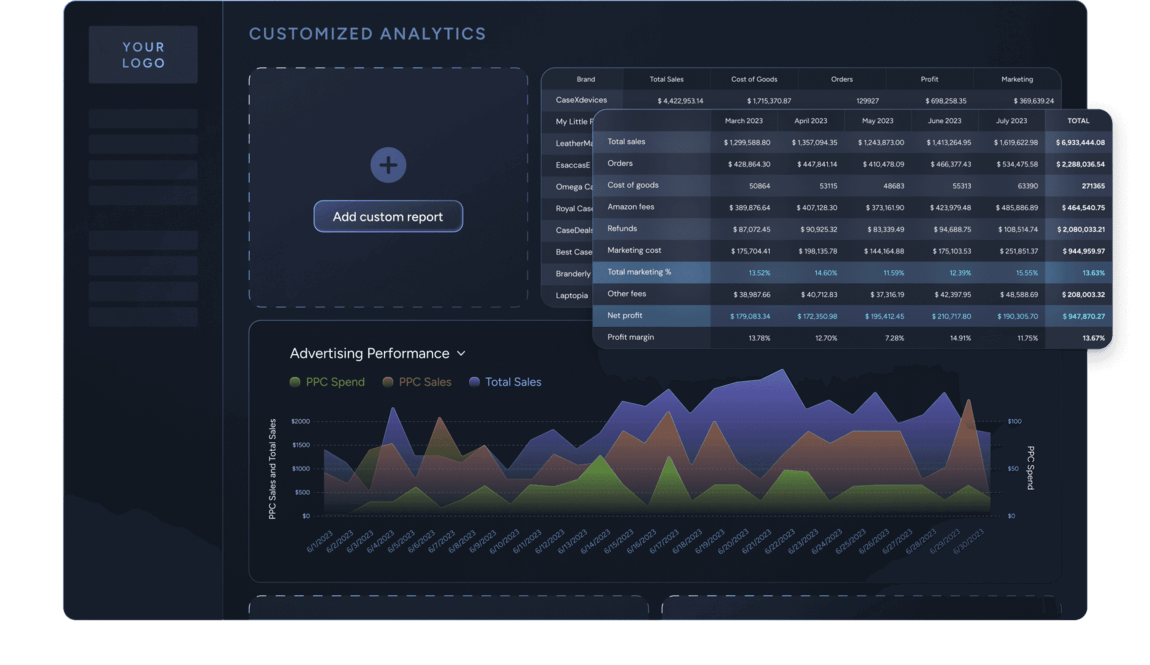

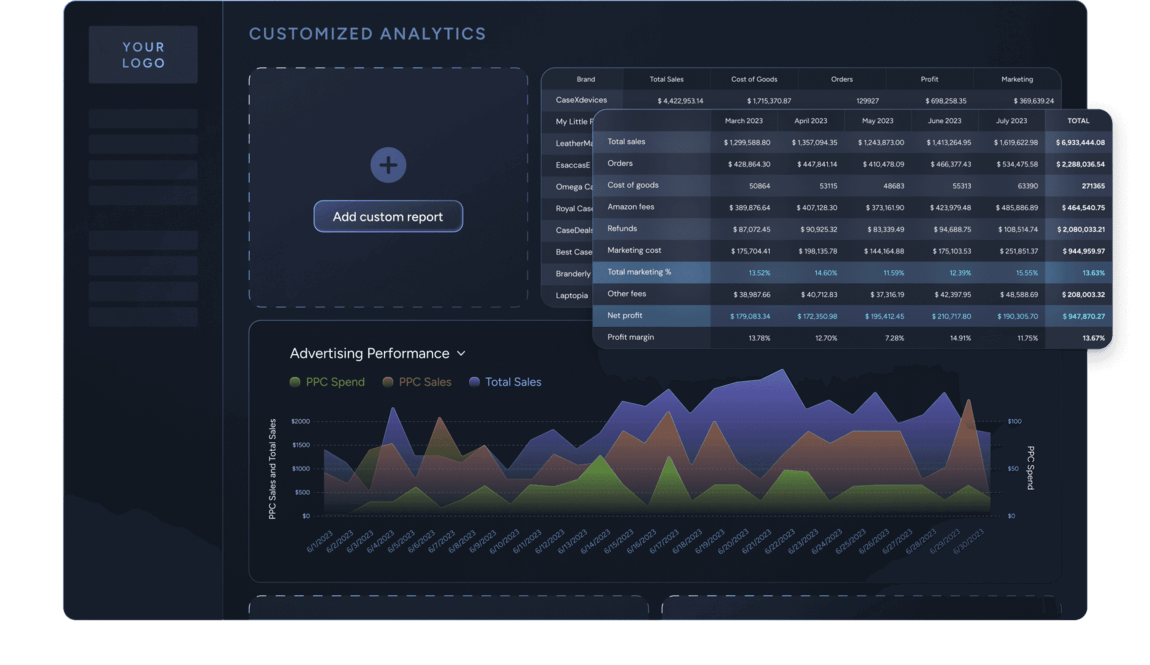

Track your sales and profit in real time by account, parent ASIN / child ASIN or custom category. Besides profit metrics, the dashboard also shows performance KPIs such as organic %, AVG price, refund rates, TACoS, etc.

Discover a calculator with a per-unit cost breakdown that allows you to adjust metrics such as price, marketing costs, or refund rates. This tool provides a clearer understanding of how changes in these expenses impact your profits and break-even points.

Get a real-time snapshot of your FBA inventory, providing you with a clear view of your stock levels, including the exact quantity of sellable, reserved, and pending inbound inventory. Find out when your products are projected to go out of stock and determine the total capital tied up in your FBA inventory.

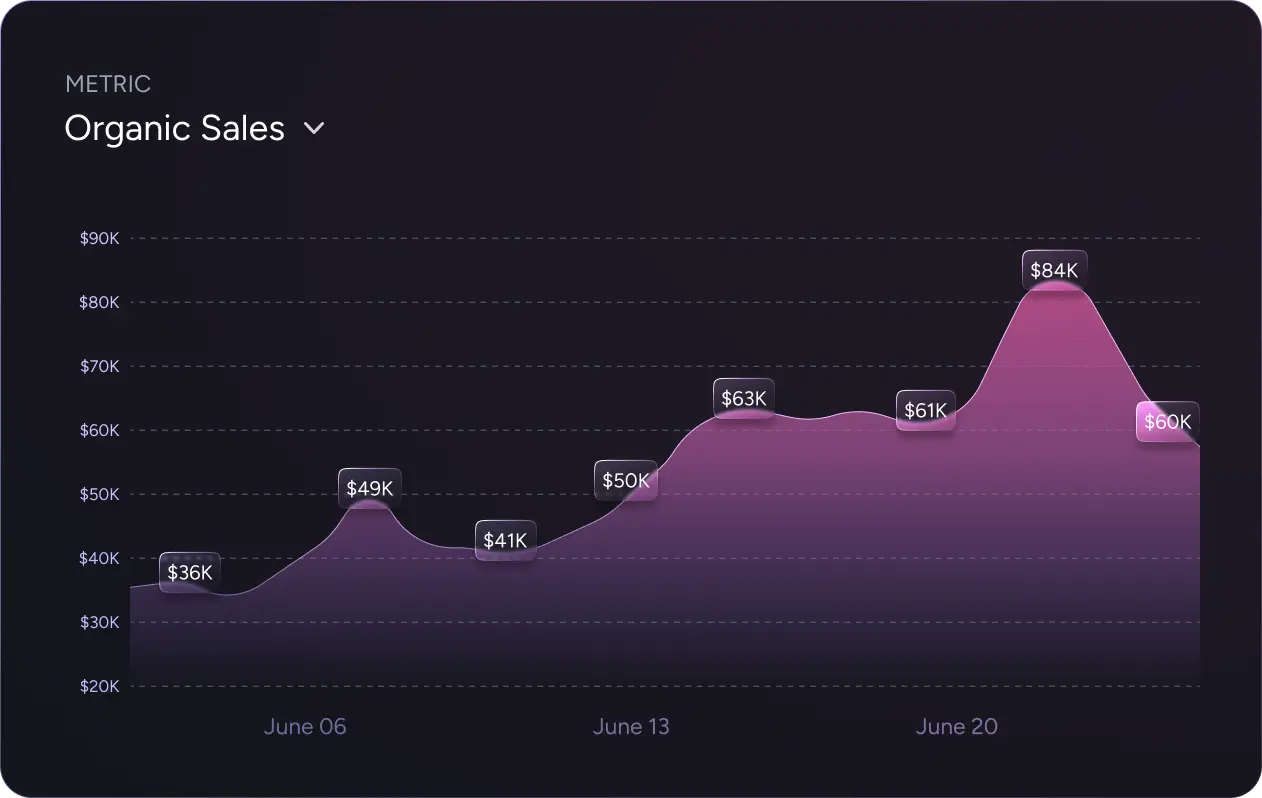

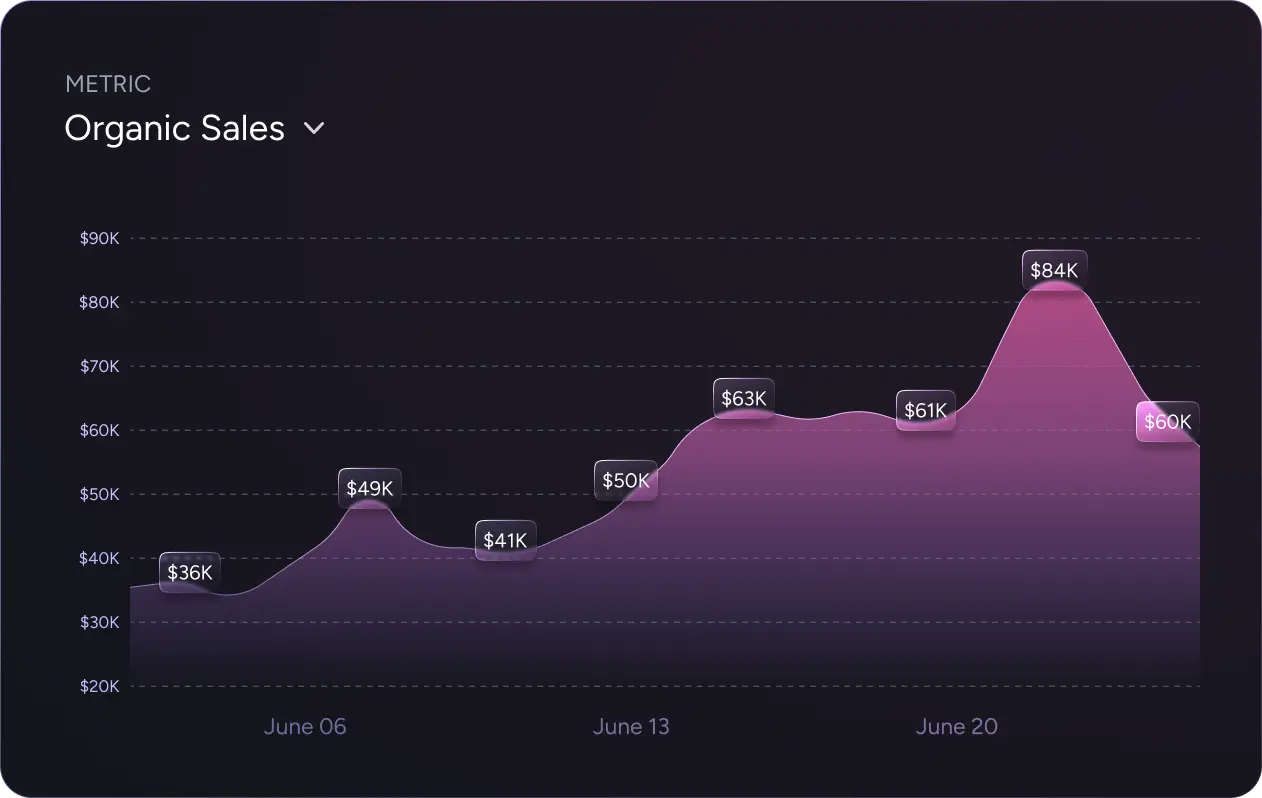

Simplified business reports with organic and PPC analysis. Easily identify changes in traffic sources (organic vs. PPC) and conversion rates. Quickly determine if you are losing organic traffic or experiencing a decrease in conversion rates.

Reports that are used by top Amazon brands & agencies

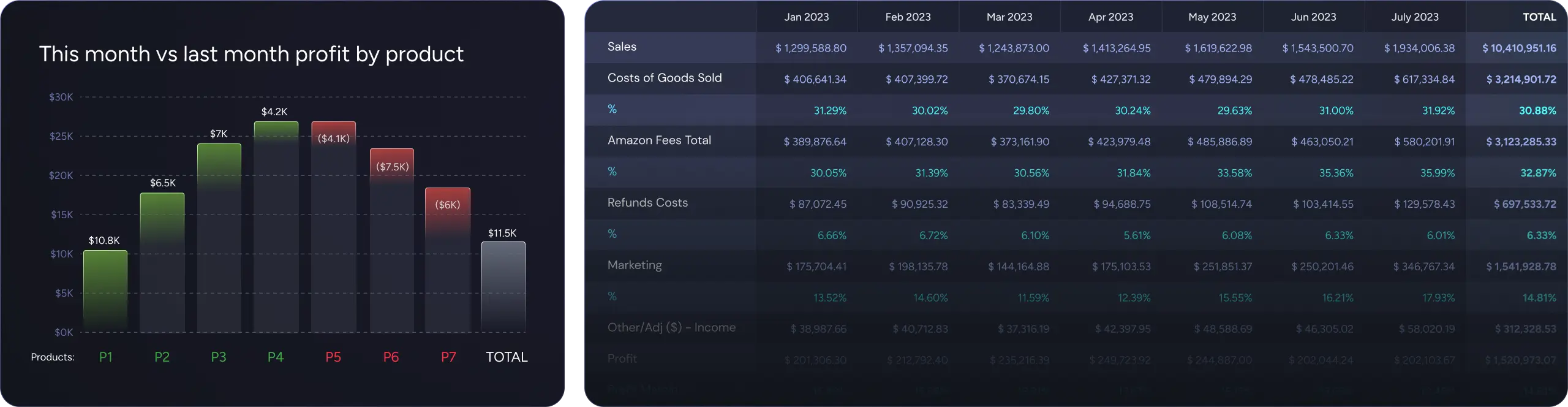

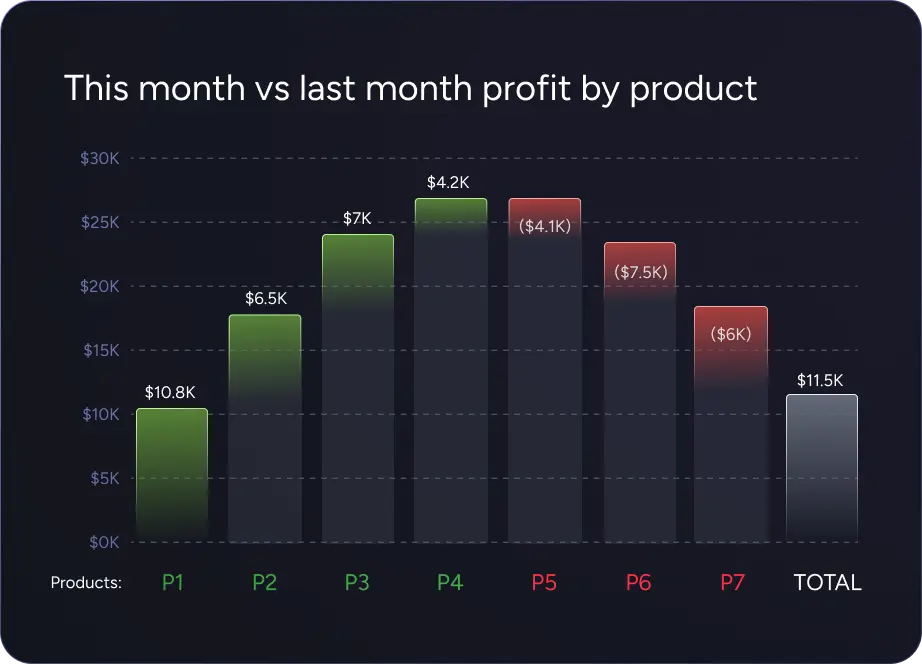

A detailed accrual basis Profit & Loss report that includes multiple level breakdowns. Compare different periods to identify the specific costs or Amazon fees that affected your ROI and margins. Determine which products contributed more or less profit compared to the previous period

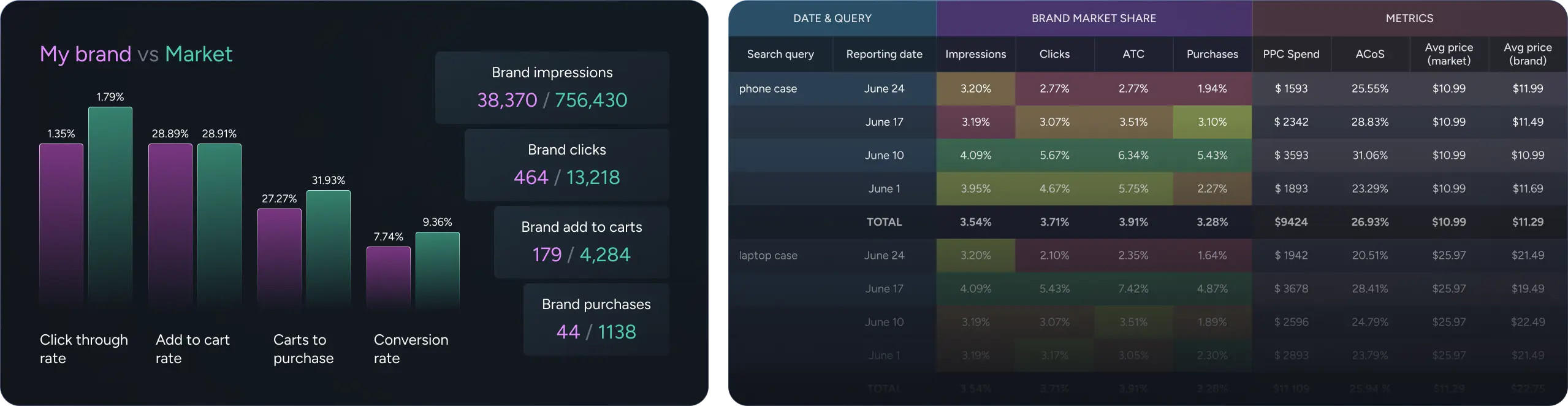

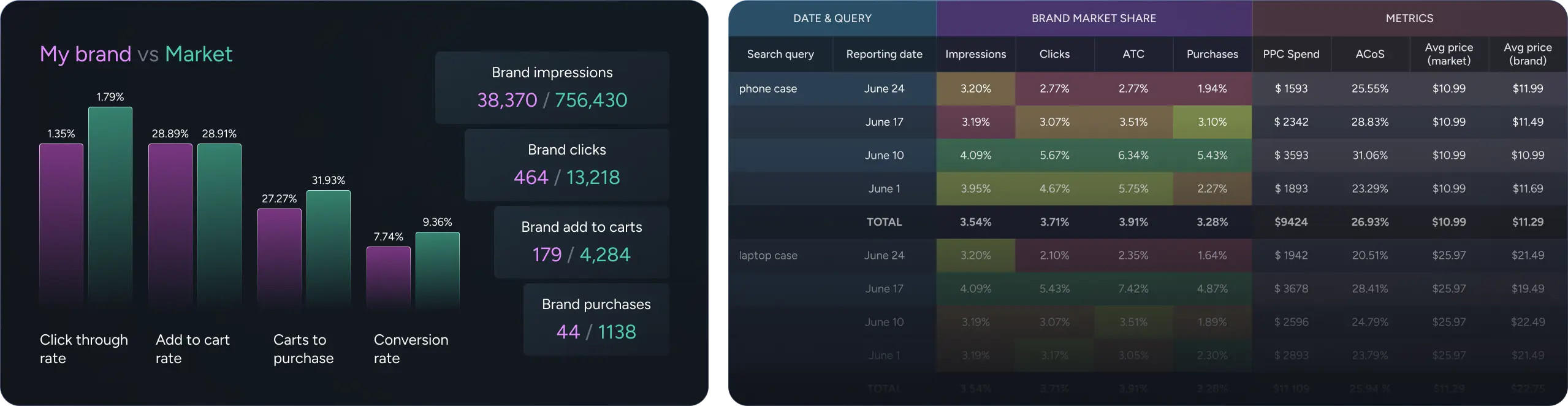

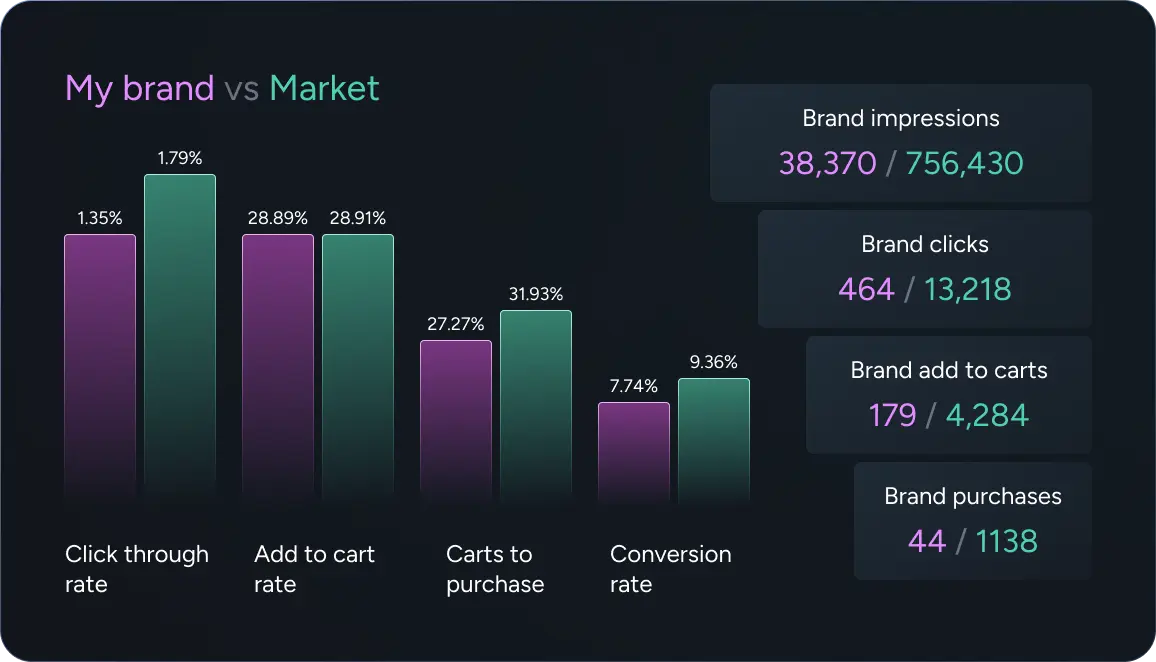

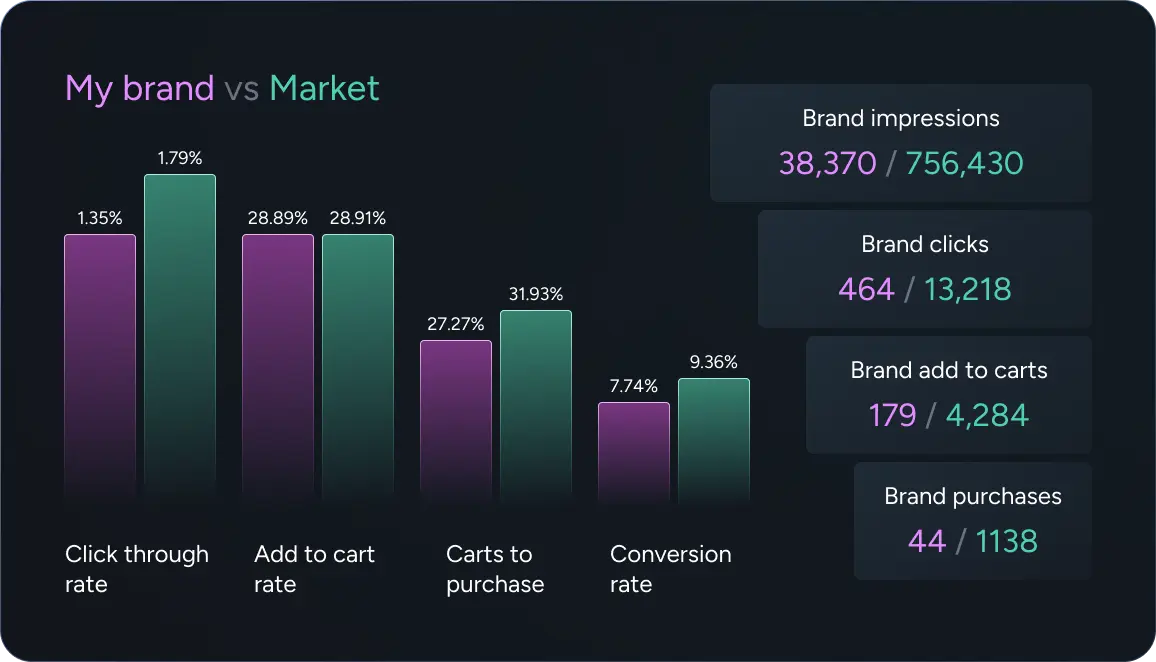

Determine the percentage of the market you are holding. Identify your market share by keyword. Track your CTR, ATC rates, conversion rates, and compare them with your competition to pinpoint where you should focus.

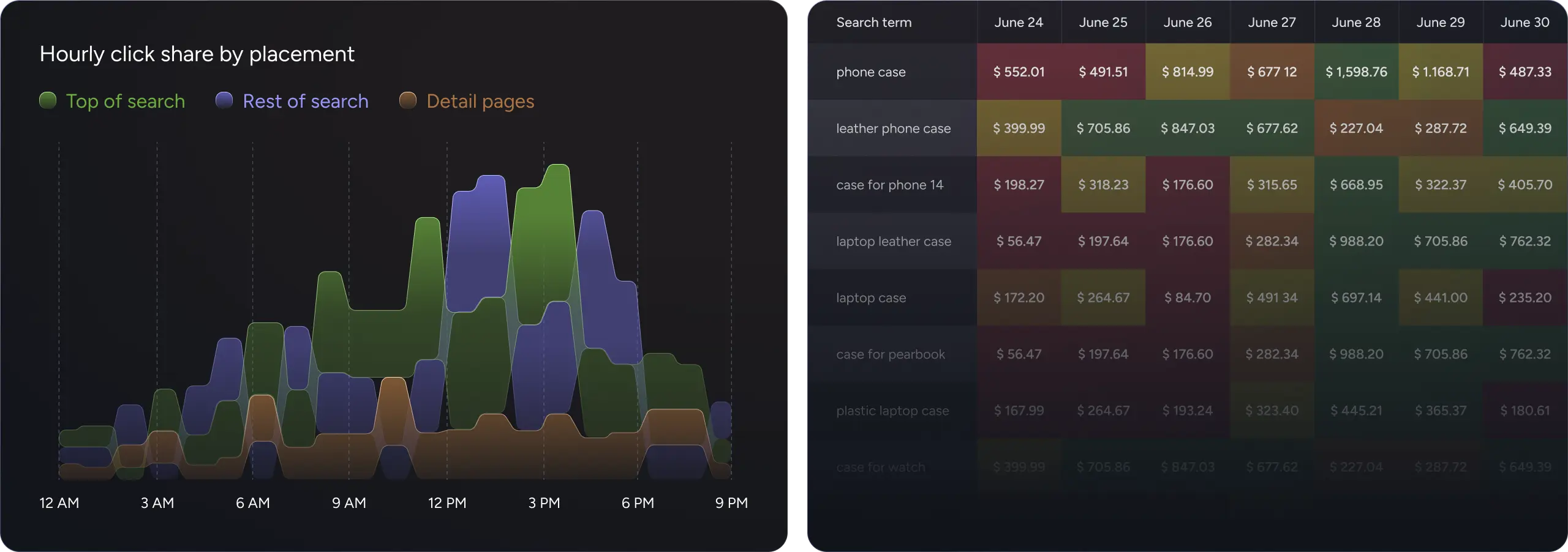

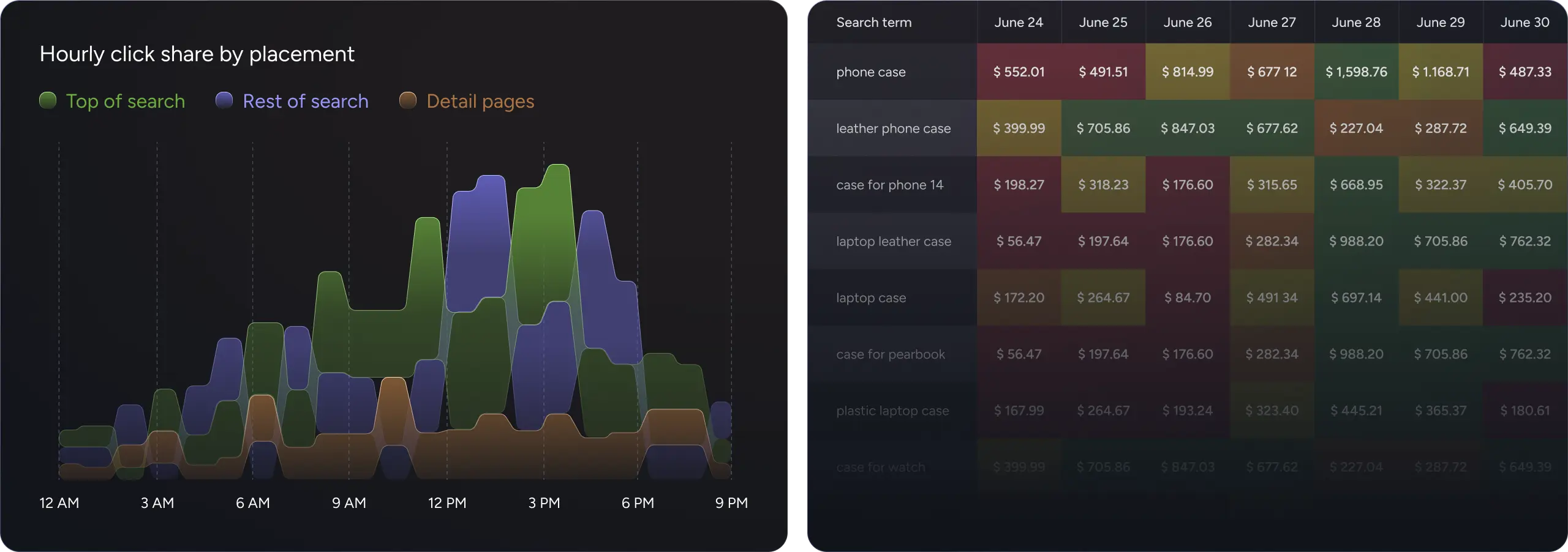

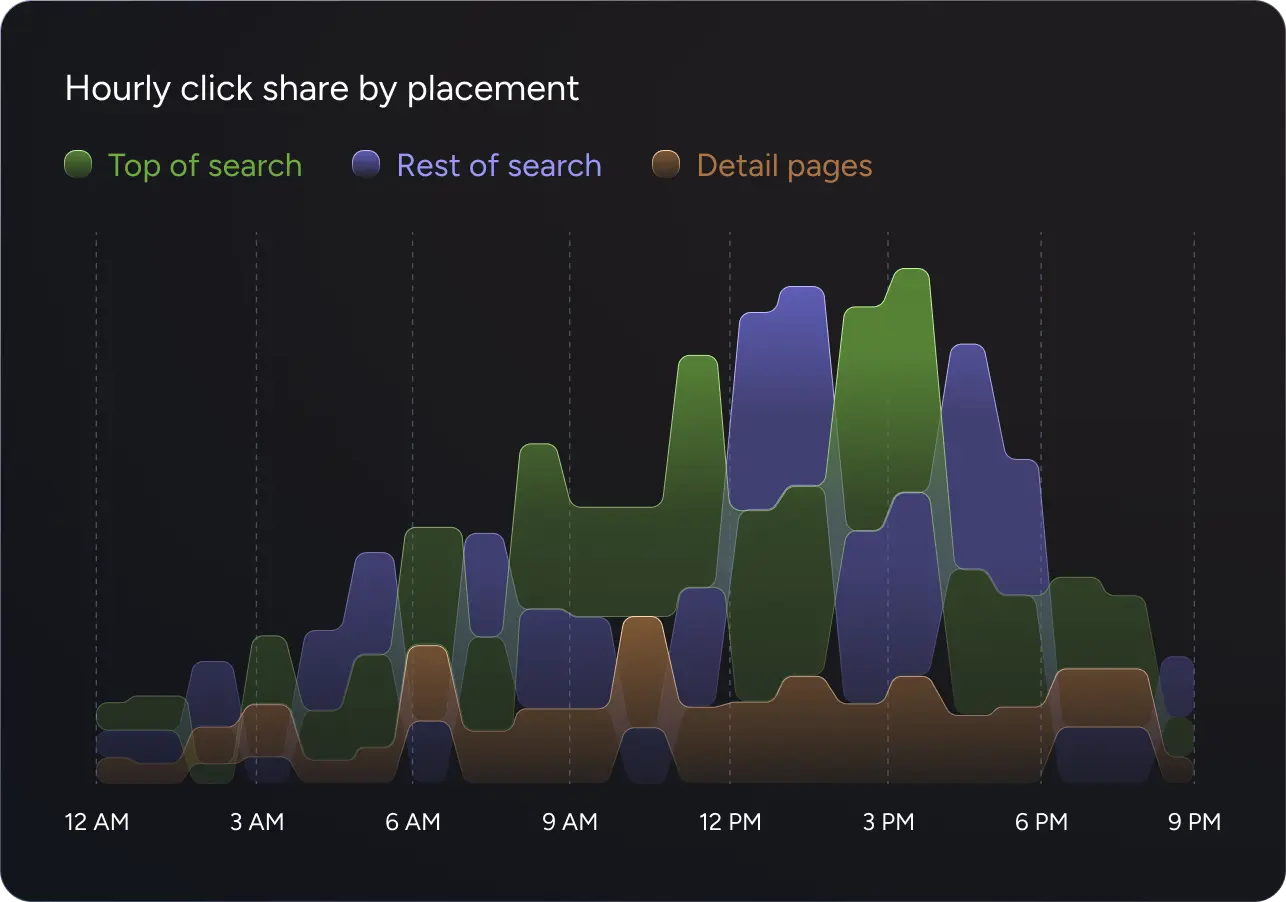

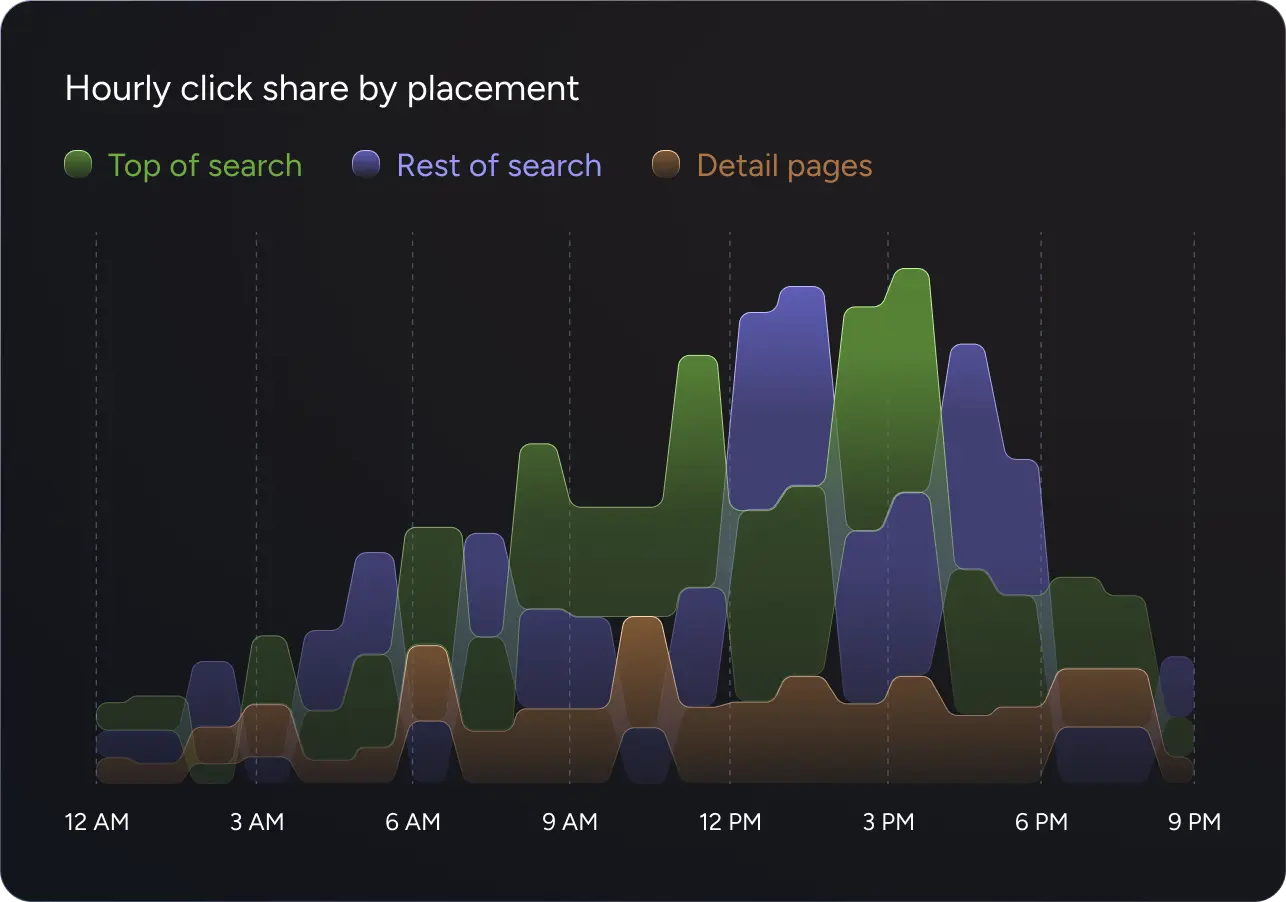

Determine the real dependency of organic sales on PPC. Identify potential issues in your campaigns through advanced search term analysis. Monitor your keyword placement performance even by the hour.

One-pager reporting that includes all important Amazon metrics: sales, profits, ppc, traffic, inventory, finances. Track all metrics on one page and use it as page tracker of your Amazon business.

Create your own customized reporting surcharged by our engine and our analytics expertise

Book a demo

Don’t just take our word for it, hear it directly from our satisfied customers