Automated search query performance analytics

Market share analysis by keyword Funnel analysis (brand vs competitors)

developer council

partner network

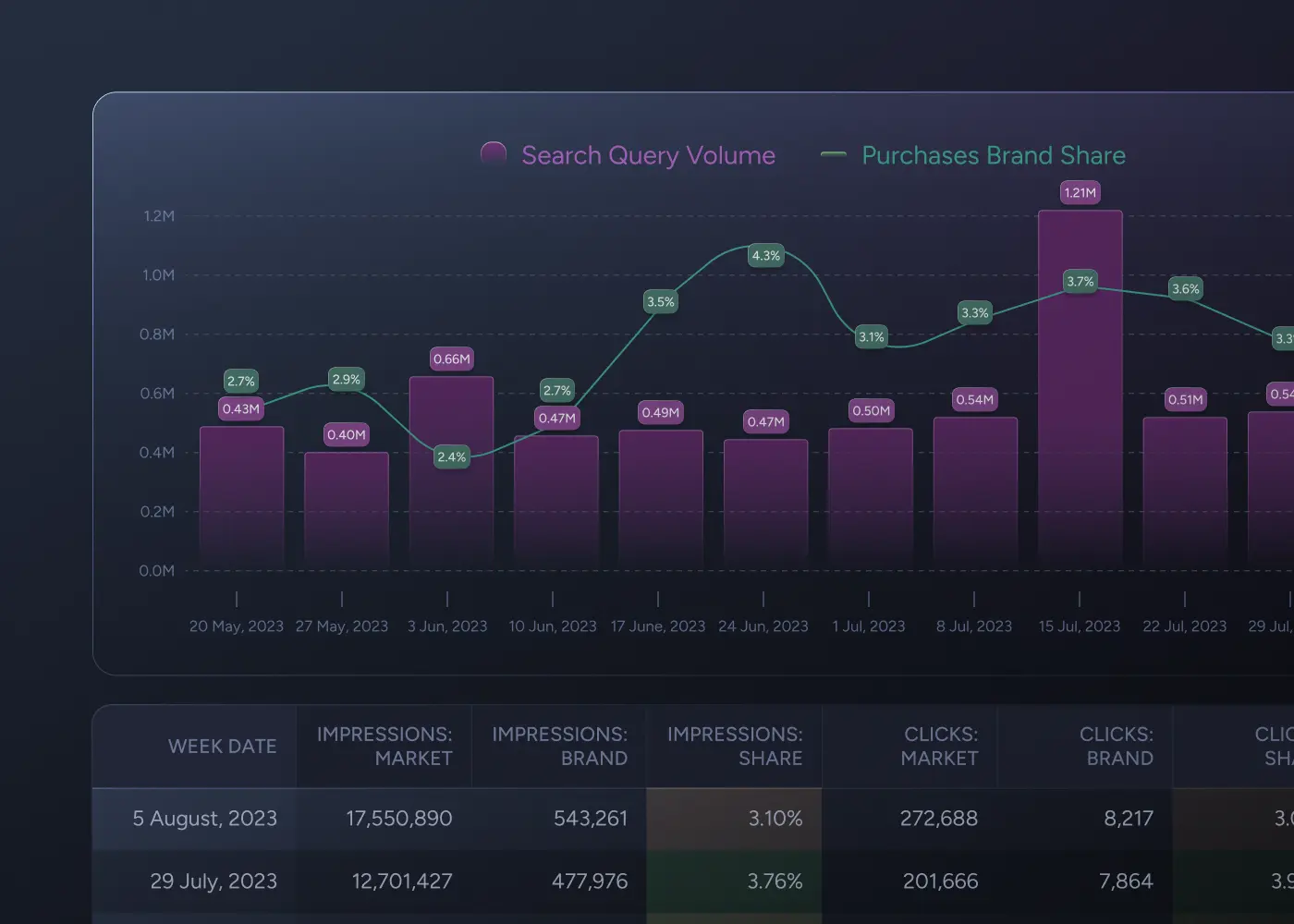

Track your market traffic trends and changes using search volume of keywords.

Discover what percentage of impressions / clicks / purchases you get by keyword.

Track your funnel performance vs competitors wether your CTR / CVR better or worse than a market

Discover what percentage of entire market you hold and how its changing week over week.

Track this data based on account / brand / keyword level.

Track your keywords search volume changes, and what % of market impressions, clicks and purchases you hold by each keyword.

We also provide you with PPC spend by keyword and AVG market price to help you identify the reasons in your brand market share changes.

Compare if your brand CTR / ATC / CVR is better than market average.

Easily define high-opportunity keywords that have better funnel performance for your brand than market.

Use our custom metric “funnel score” to track all metrics CTR / ATC / CVR vs market in one.

Using Search Query Performance Report you can track what percentage of the total purchases your brand holds by keyword.

1) If your brand click-through rate (CTR) is lower than market CTR, then it means that shoppers aren’t clicking on your listing in search results, and you should optimize your listing product images with an emphasis on the main image.

2) If your brand add-to-cart rate (ATC) is lower than the market ATC, then it’s a listing copy issue, and you should optimize your bullet points, A+ content, and reviews. Alternatively, you are higher priced than market then it can be reason, but there is nothing you can do about it. Only getting “overall pick” or “best seller” badge might fix this.

3) If your brand’s add-to-cart-to-purchases ratio (ATC to PUR %) is lower than the market average, then you should compare your pricing to the competitors and how you compare. Conversion rate is the metric that shows your brand’s Amazon sales funnel overall performance compared to the market. Additionally, this might result from other variables like competitive advantage, delivery speed, and product quality.

Listing optimization goes a long way to boosting your product discoverability and improving your Amazon market share. Comparing your search query analysis brand data vs. market data can help you identify areas of your listings that need optimization. For example:

The Search Query Performance Report provides market performance data and lets you compare your brand’s performance to the overall market performance. The best part is that the search query tool provides this data for each keyword. The screenshot below shows how brand vs market performance search query analysis data is presented on My Real Profit using SQPR data.

Brand Performance Vs. Market Performance Search Query analysis

You can compare your CTR, add-to-cart rate, and conversion rate against the market average using different keywords that show different customer purchase behaviors. As if that’s not enough, the brand performance vs. market performance data can help answer questions like:

If your Impression Brand Share is lower than your Purchase Brand Share, it means that despite having less visibility, you get more purchases for that keyword. This means your product is more likely to be purchased than your competitors.

It will be the opposite of high-opportunity keyword performance, as described above. If a search query has a higher impression share/click share but a lower purchase share, then that’s a bad-performing keyword.

Paid advertising is crucial to building an effective Amazon marketing funnel. Leverage Amazon Sponsored Products to target relevant keywords identified through an Amazon keywords search tool like SQPR. This increases product visibility, drives qualified traffic to your listings, and help you improve your organic rank.

Pricing and PPC spend are the two Amazon advertising funnel factors with the most significant impact on your market share. Simply put, if you decrease your price, your market share will increase, and if you increase your PPC spend, your market share will increase.

You can use the Search Query Performance Report to track the search volume changes, which can, in turn, help you with product forecasting. Planning your inventory around the Search Performance data means utilizing fundamental market data, free from the effects of internal company factors (like out-of-stock periods or deals).

You need market traffic data to reveal the seasonality, indicating when demand will increase and decrease. The market traffic data, in this case, is the Search Query Volume metric. We recommend using account-level data and selecting only relevant keywords for a product.

Here’s how you do it.

Let’s say you add up the monthly search volume for the top 20 keywords for your ASIN for last year and create a chart. You’ll define the seasonality of those keywords and, by extension, your product’s seasonality.

The next step is comparing each month’s search volume metrics to the previous month’s to get a percentage change in search volume month over month. These percentage changes will help you estimate your units sold.

For example:

February = +10% in search volume vs. January

March = -5% in search volume vs. February

Suppose you sold 1000 units in January. Based on the percentage search volume changes month over month, February units sold: 1000 units + 10% change in volume = 1100 units. And March units sold: 1100 units – 5% change in volume = 1045 units.

Now, you have an inventory plan using market traffic.

Once you factor in your brand’s growth percentage and market traffic change percentage (compare this year’s traffic to last year’s or estimate it), you’re good to go!

Impressions

This metric represents the number of product views appearing in search results for a specific query. Under impressions, the Search Query Performance Report offers more metrics like:

You can see ASIN metrics in the ASIN View report:

Clicks

This metric tracks the number of times customers click on products displayed in search results after entering a specific query. The Search Query Performance Report further breaks down clicks into these metrics:

Cart Adds

This measures the times a shopper added a product to cart after searching on Amazon using the specific query. This metric is further broken down on the Search Query Performance Report into:

Purchases

This metric shows the number of orders placed by customers per search query. Note that this metric indicates the number of orders and not the number of units sold. The attribution window for this metric is 24 hours, so if a shopper places an order 24 hours after running the search, that purchase won’t be attributed to the search query.

The Purchase metric includes organic and sponsored product sales (top of search and rest of search). It also includes canceled orders. Sponsored Brands, Video, Sponsored Products Highly Rated, and Sponsored Display sales data aren’t included in the Purchases metric.

Just like the other metrics, the Purchases metric is divided into:

Amazon Search Query Performance Report is Amazon-provided data showing each keyword’s brand performance. My Real Profit automates your SQPR data, so you don’t have to keep generating the report when you want to look at your performance insights. The SQPR data shows you brand and market data for each keyword.

It’s a goldmine of competitor insights that helps you compare your brand performance to the competition.

The primary requirements for eligibility for the Search Query Performance Report are a professional seller account and brand registration on Amazon’s brand registry. You must also comply with Amazon’s policies and maintain excellent seller performance metrics.

Search Query Performance Report includes the top 1000 keywords sorted from highest to lowest by Search Query Score.

In the next column to the right, we have the Search Query Volume, which shows how many times a search query was used to search on Amazon within a specified timeframe.

My Real Profit integrates with your Amazon account via API as we are an official developer approved by Amazon, allowing for a seamless connection and data transfer between Amazon and our platform.

The Amazon Search Query Performance Report offers Brand View and ASIN View.

Brand View provides insights on all search terms where your entire brand’s products appeared in search results. It’s ideal for understanding overall brand visibility and SOV.

ASIN View focuses on a specific product (ASIN) and reveals search terms where that particular product appeared in search results. It helps analyze individual product performance and market share within its category.

The Search Query Performance Report doesn’t give insight into the competition’s Amazon keyword rank analytics. However, you can see competitor data like CTR, conversions, and market purchases for a specific keyword.

Yes, your data is secure in My Real Profit. We are listed in the Amazon app store and utilize Amazon Web Services (AWS) for secure data handling and storage.