Amazon Marketplace is an excellent platform for online businesses. With its wide range of products, Amazon has become the go-to destination for entrepreneurs and buyers alike.

With the right strategies and tactics, Amazon businesses can become successful and profitable. In this article, we’ll discuss some tips for business owners and buyers interested in taking an existing FBA business.

What is Amazon FBA business model?

To understand the whole process of selling Amazon FBA business, you must first understand what Amazon FBA model is. Amazon’s FBA program enables sellers to send their products straight to Amazon fulfillment centers.

After that, Amazon takes care of the entire order processing process, including storage, picking, packing orders, shipping products to customers, and handling returns. This means sellers do not need to worry about any logistical aspects of running an online business.

How to sell or buy an Amazon business?

People might want to sell or buy Amazon FBA business for different reasons. Both sides must know what to do to have a good deal. Here are the most important steps for doing this.

Step 1: Research, planning & preparation

Before looking for an FBA business or selling your own eCommerce business, it is important to do some market research and make a plan.

If you are going to sell your company, you need to have the last 24 months’ P&L and balance sheet ready. It will be the first thing buyers will require from you.

If you are going to buy a company, conduct market research about the categories you are interested in. Understand the average margins and the specific details of each category.

Step 2: Find a seller/buyer

Once you have done your research, planned out your strategy and got some documents on hand for selling or buying an Amazon FBA business, you can begin searching for prospective buyers or sellers. You can utilize online platforms, or use brokers specializing in Amazon FBA transactions.

Step 3: Valuation & negotiations

You have identified a potential buyer/appropriate business, it’s time to negotiate the terms of the sale. The business owner should provide accurate financial information that can be used to determine the fair market value.

Both parties must agree on the price and other vital aspects such as warranties, payment plans, as well as the transfer of all assets to the new owner.

Step 4: Due diligence & closing the deal

Once an agreement has been reached, it is time to perform a thorough due diligence process on both sides to ensure that everything is legitimate and all details are correct.

This includes reviewing all financials and contracts, as well as verifying the seller’s inventory. Once everything checks out, both parties can sign the contract and complete the sale.

Step 5: Transferring ownership

After signing the contract, the seller must take all necessary steps to transfer ownership. These steps include updating the Amazon Seller Central account, transferring FBA inventory, and notifying third-party providers such as banks and suppliers about the change in ownership.

Where can you sell or buy an Amazon seller account?

The best variant is to use a private sale or a business broker. Private sales are typically used by business owners who want to sell their businesses privately, giving them more control over the transaction and the ability to negotiate better terms.

Many Amazon FBA business owners post information about selling their businesses in forums, newsletters, and Facebook groups. Usually, you can contact them directly by using the contact details they provide. Additionally, there are numerous private sale websites, such as Flippa, where you can find many Amazon FBA businesses for sale.

On the other hand, online business brokers specialize in matching buyers and sellers, so they may be able to provide more detailed information about the deals available on the market. Additionally, many online brokers also offer services that can help buyers and sellers with the due diligence process.

Tips for sellers: how to sell an Amazon FBA business

When should you think about selling your FBA business?

There is no definite answer to this question, as it depends on individual circumstances. However, some common reasons to sell a business include retirement, change in personal goals or interests, and financial difficulties. But if you want to sell your FBA business profitably, it is crucial to satisfy several criteria:

your Amazon FBA account is at least two years old;

your business is thriving;

your business is not in serious financial distress.

How to prepare your e-commerce business for sale?

Before you can sell your business, you need to make sure that it is attractive to potential buyers. The Value Pyramid represents the five components that are most important to potential buyers when they look at your business: brand, growth and profitability, risk, transferability, and documentation.

For an FBA business to be in good standing and sellable for a high price, it requires a minimum of three layers. The most impactful and valuable layers – growth and brand – are necessary. Without a brand, a business has no value, making it the most crucial for buyers.

Ensure potential buyers can easily assess the benefits of purchasing your business and stand out among other Amazon businesses; focus on increasing brand awareness, optimizing product listings, and gathering financial and operational documentation.

Show strong brand

People who purchase a pre-established business look for a brand that is unique, has high visibility in the Amazon marketplace.

Traffic

Check your conversion rates. Increase your online presence and drive more traffic to your Amazon store and other platforms. Optimize your product listings for better search engine rankings.

Products

Diversification is crucial for an e-commerce business. You must have heard the saying about not putting all your eggs in one basket. If you have just one product driving all your profits, your multiple will be lower than the market average.

Suppliers

Having exclusive contracts can bring significant advantages to your FBA business. While potential buyers may not consider supplier contracts a top priority, they can add extra value.

Gather financial & operational documentation

Do you know that the value of your business is based on your net income for the last 12 months? Therefore, you must get your financials in order well in advance. To prepare your FBA business for sale, you should focus on three primary financial statements:

Profit and loss statement

Total sales: revenue from all platforms;

Cost of Goods: inventory landed cost;

Marketplace fees: Amazon fba fees, PPC, other marketplace fees;

Gross profit: revenue from sales minus the cost of sales;

Operating expenses: fixed costs needed to keep your business running from month to month;

Net profit: gross profit minus operating expenses

Net profit margin: net profit divided by total sales

Note when you sell your Amazon business, it is important to show the P&L in an accrual method. This is especially important for FBA businesses, as there can be a lot of money tied up in things like inventory.

Cash accounting can make your net income and SDE appear much lower than they are. Additionally, keeping your company’s business analytics well-organized and easily accessible will be valuable when the time comes to make key decisions. If your Amazon business is well documented, you can sell it for a higher price.

Balance Sheet

Assets: are resources owned or controlled by your company that create value. They can include cash, accounts receivables, inventory, fixed assets, and prepaid expenses.

Liabilities: debts owed to another company or creditor.

Equity: the amount invested in the business over time through investments or retained earnings.

Cash flow

Operating Cash Flow: money received from sales or paid to support business operations, such as purchasing goods.

Investing cash flow: cash used to buy or sell assets such as inventory.

Valuing an Amazon FBA business

Determining the value of your business can help you decide whether to sell it immediately or invest more effort in improving its value.

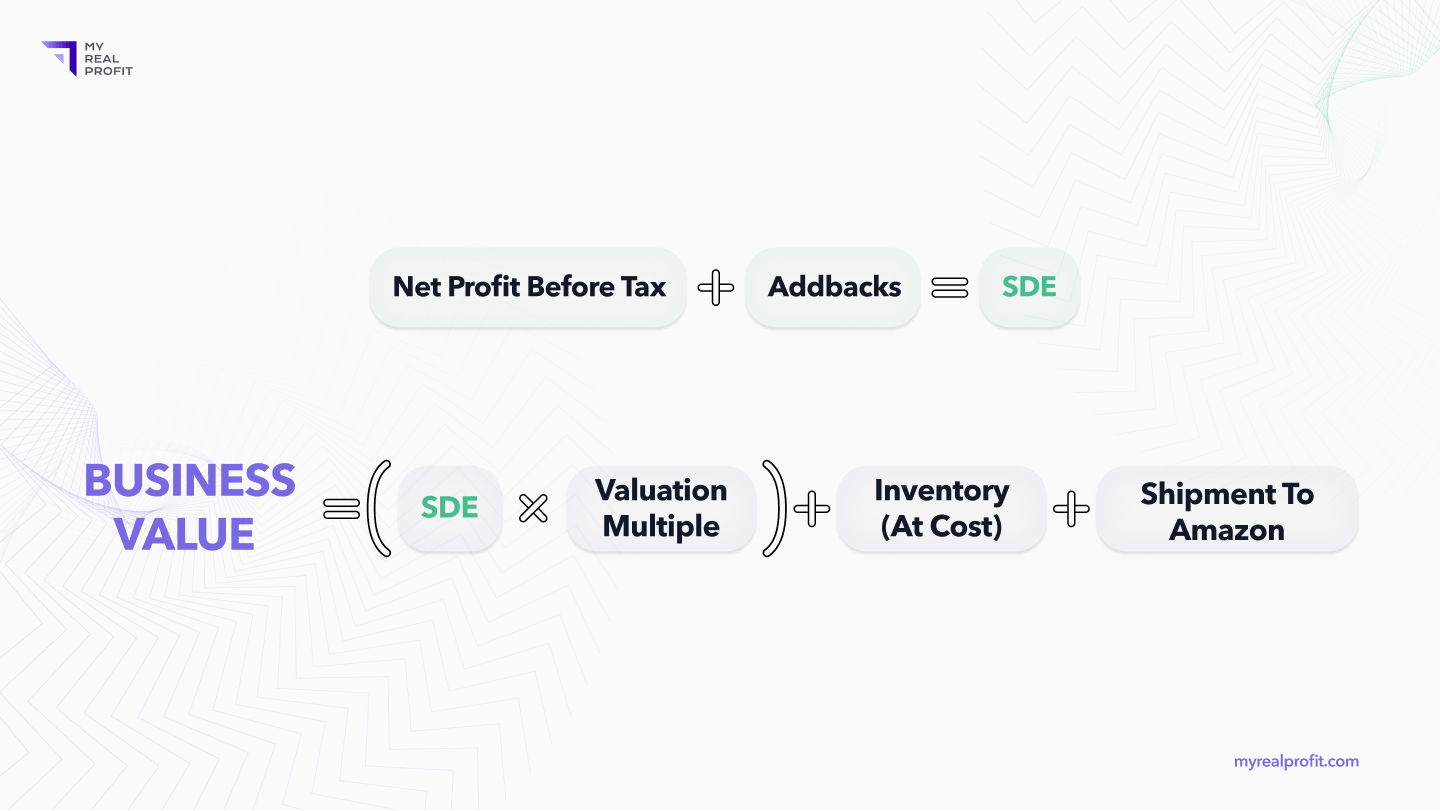

The value of a business is based on the company’s financial performance, potential growth, and the strength of its brand. The value of your Amazon FBA business considers two primary factors: profits and multiple. The formula for calculating the estimated sale price is as follows:

Where Seller’s Discretionary Earnings (SDE) determine the total annual financial benefit. Addbacks – unregular expenses for business operations. The multiple is usually determined by factors such as the age of the business, size, and growth potential or category.

For example, your Amazon FBA business created a profit of $100,000 in the last year. The buyer has offered 3X multiple means that your business will be valued at $300,000. So, you can get $300,000 for your Amazon FBA business. Plus, you will receive money for the inventory.

Protect yourself against scammers

When selling your Amazon FBA business, it is important to protect yourself from scammers. After identifying potential buyers who have expressed interest, you must have them sign a Non-Disclosure Agreement (NDA). This agreement outlines their responsibility to keep your confidential data secure.

Ensure you follow the legal requirements for selling a business and use reputable escrow services to ensure that payments are received in full and on time.

Additionally, make sure you ask prospective buyers for proof of funds so that you can be sure they can purchase your Amazon business. Finally, consider consulting with an experienced business broker or lawyer to help you navigate the selling process and ensure your interests are protected.

Tips for buyers: How to find a successful FBA business for sale

Buying an Amazon FBA business with high potential can be exciting and financially rewarding. However, it is important to make sure you do your research before investing in a new company.

Knowing the ins and outs of current Amazon trends, understanding the profit margins involved, and ensuring that the newly acquired business has been run successfully are all key factors to consider when purchasing an FBA business.

Buying Amazon FBA business vs. starting your own?

If you’re thinking about online business acquisitions, you may wonder whether buying an existing business or starting your own is the best option.

While both options have pros and cons, most people new to Amazon typically buy businesses that are already up and running. Because it’s generally easier and faster than starting from scratch. Let`s look at some advantages and disadvantages of buying an FBA business.

Advantages:

Benefit from the existing reputation, customer base, and marketing strategy.

Don’t need to invest your time or resources in researching potential markets or building a brand.

Quick jumpstart your business with the existing infrastructure.

Disadvantages:

May need to make costly upgrades and changes to keep the business competitive.

Difficulty in transitioning the existing customer base to new ownership.

Risk that former owners may have hidden liabilities or legal issues.

After considering these pros and cons, you can then decide whether starting your own business from scratch or purchasing an existing Amazon FBA business is right for you.

Read: Is it worth selling on Amazon in 2023: Let’s figure it out!

How to analyze Amazon FBA businesses before buying one of them

Before you invest in an Amazon FBA business, it is important to look at things like the seller account from the person before you and how much they sold, how much money they made, and what customers said about them. Additionally, you should analyze all the details and assess the risks involved. Here are some tips to help you analyze FBA businesses for sale from every angle:

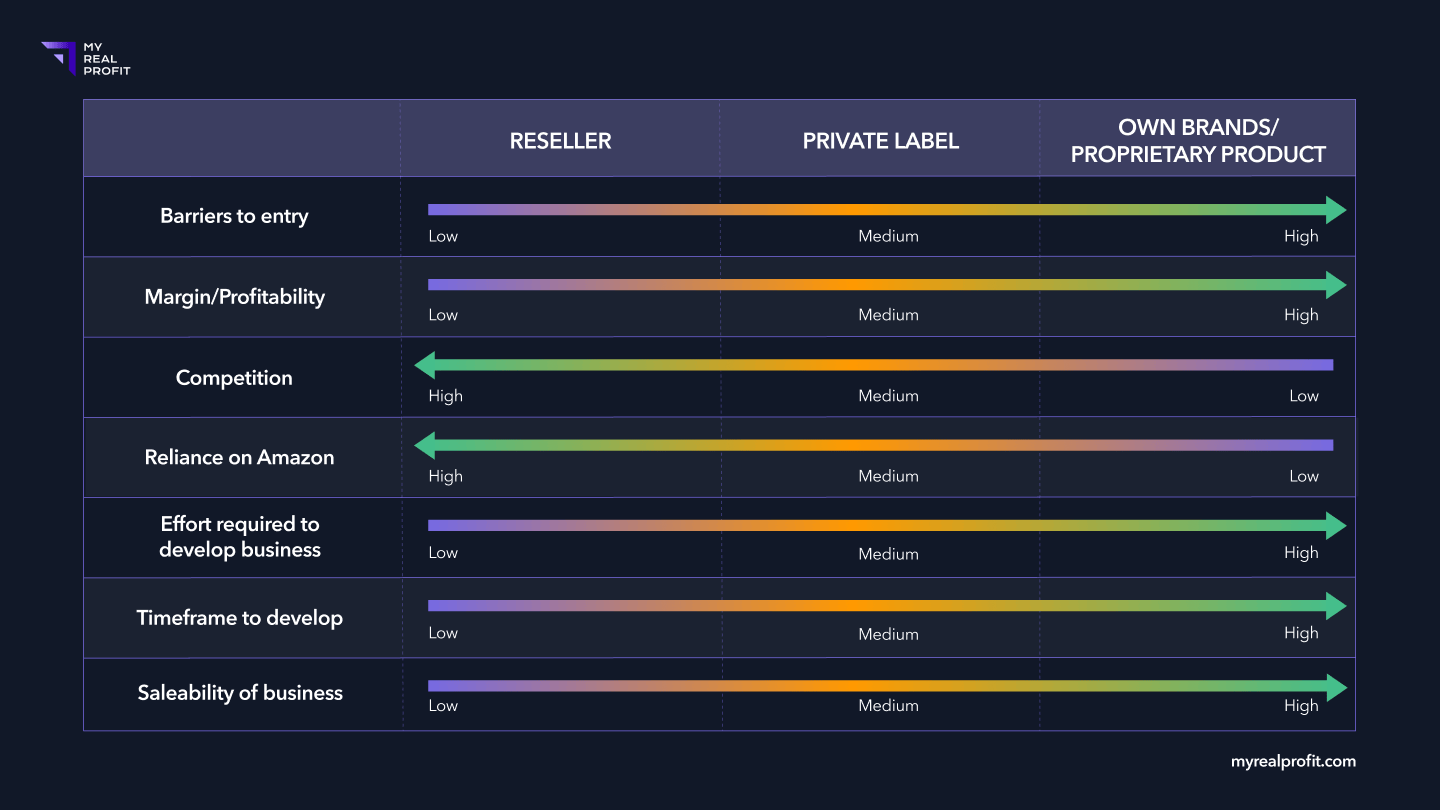

Business type

The first thing to consider when buying an Amazon FBA store is the type of business you are buying. For example, if you are looking for an Amazon FBA business, there are a few different types to choose from: reseller (retail arbitrage), private label, and even companies with their own proprietary products. Each of these has its benefits and drawbacks so it’s important to understand which one fits your goals best.

Age of the business

Another important factor to consider is the age of the business. Amazon seller accounts are only as valuable as their history and track record.

If the FBA business has been around for a long time, then it’s likely that it will be more successful than one that’s brand new. On the other hand, new businesses valued at a lower price may be more attractive, but it comes with more risk.

Accounting records and financials

When buying a business, it’s important to look at the accounting records and financials of the company.

This will give you an idea of how much money has been made in the past, what expenses are associated with running the business, and whether or not there could be any liabilities.

Amazon account health

You’ll need to make sure that Amazon seller account health is good. Check the seller account feedback, customer reviews, and other key metrics.

This will help you understand whether or not customers are satisfied and how profitable business has been managed in the past.

Marketing strategy

A successful Amazon store requires a solid marketing strategy. A thorough analysis of the current market trends will help you determine if potential buyers will find a product attractive and whether the competition is fierce.

Check on the current advertising methods that are being used, such as SEO, PPC, influencer marketing, or other tactics. A good marketing strategy can help generate organic sales and increase profits.

Analyze the competition

It’s important to understand the competitive landscape when buying an FBA business. Analyze other business owners in the same categories and complementary niches.

This will help you assess how competitive the market is and whether or not to sell in this niche.

Barriers to transferability

Finally, it’s cruel to check for any potential barriers to transferring ownership of the FBA business. Look at the seller agreements from Amazon and any other platforms the business is listed on. Ensure that there are no issues with tax or regulations that could prevent you from taking over as the new owner.

Additionally, look into any licensing agreements that may be attached to the FBA business and ensure that those will transfer to you as a new owner. By taking the time to analyze these elements, you can make sure that you’re buying a profitable business that is well-positioned for success.

How much capital should I start with if I want to buy an FBA business?

The amount of capital you need to buy an Amazon store will depend on many factors, such as the age and size of the business, its profitability, and the competition in the niche.

Generally speaking, however, it’s best to start with a budget of at least $50k for a small-scale startup or $500k+ for a more established business.

Conclusion

Whether you’re selling or looking to buy an Amazon FBA business, with the right analysis, proper research, and due diligence, your deal will be a success. If you have a seller account, it is essential to keep track of all the numbers related to your business performance. That way, you can get a better price when selling it.

When buying an Amazon business, check the company’s background and finances. Find out how much money the business has made in the past and if it is likely to make money in the future. Ask questions about any problems that have popped up during ownership. Get all of this information before deciding to buy. With the right approach, you can be sure that your deal is a win-win.