E-commerce business sounds like a very lucrative business model, especially with Amazon. It handles all your deliveries and returns of your products. There are no limits to scalability.

Thanks to Amazon FBA, you will be confident that everything is delivered on time regardless of the number of units sold. Nevertheless, using Amazon FBA includes many costs associated with this business model.

To increase profits, amazon sellers need to keep an eye on their profit and loss, reporting tracking as much amazon data as they can.

Let us do a detailed breakdown of how you should calculate your Amazon profit and what amazon seller fees you should include for true profitability calculation.

Profit calculation formula:

Amazon sales –

Cost of Goods Sold

Amazon Fees (Referral Fee, FBA fee, Storage Fee)

Refunds

Discounts/Promotions

PPC costs

Other Amazon Fees (Adjustments, Removals)

= REAL AMAZON PROFIT

Two possible methods of Amazon profit calculation:

- Cash Method.Cash Method is based on when Amazon deposits the money into your Amazon account and, every 14 days, makes transfers to your bank account (disbursements).

- Accrual Method.Accrual Method is used when the product customer purchased your item, regardless of when Amazon paid you.

The main difference between these methods is timing.

Which method should you use for your business?

The answer is accrual. We highly recommend using the accrual method, as it provides a more accurate picture of your business’s profitability. And here is why:

Let us compare sales and ad spend on the current payout vs. other seller central reports.

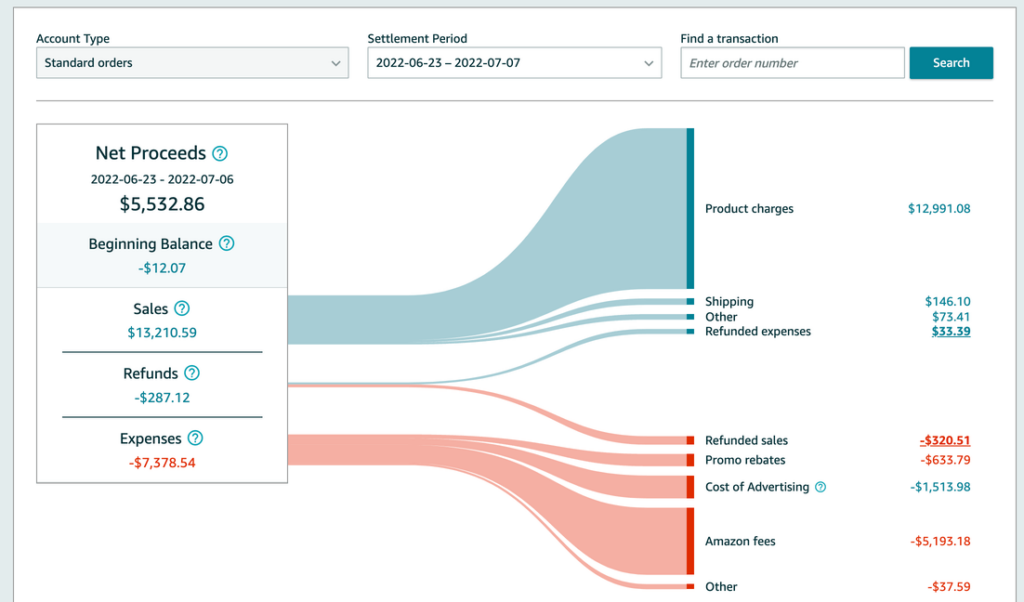

PPC Spend and Advertising Sales Data

As all Amazon sellers, you focus on PPC and keep track of your sales correlation to your marketing budgets. Amazon advertising console shows you ad spend and sales based on an accrual basis. Let’s compare it to the amazon payout.

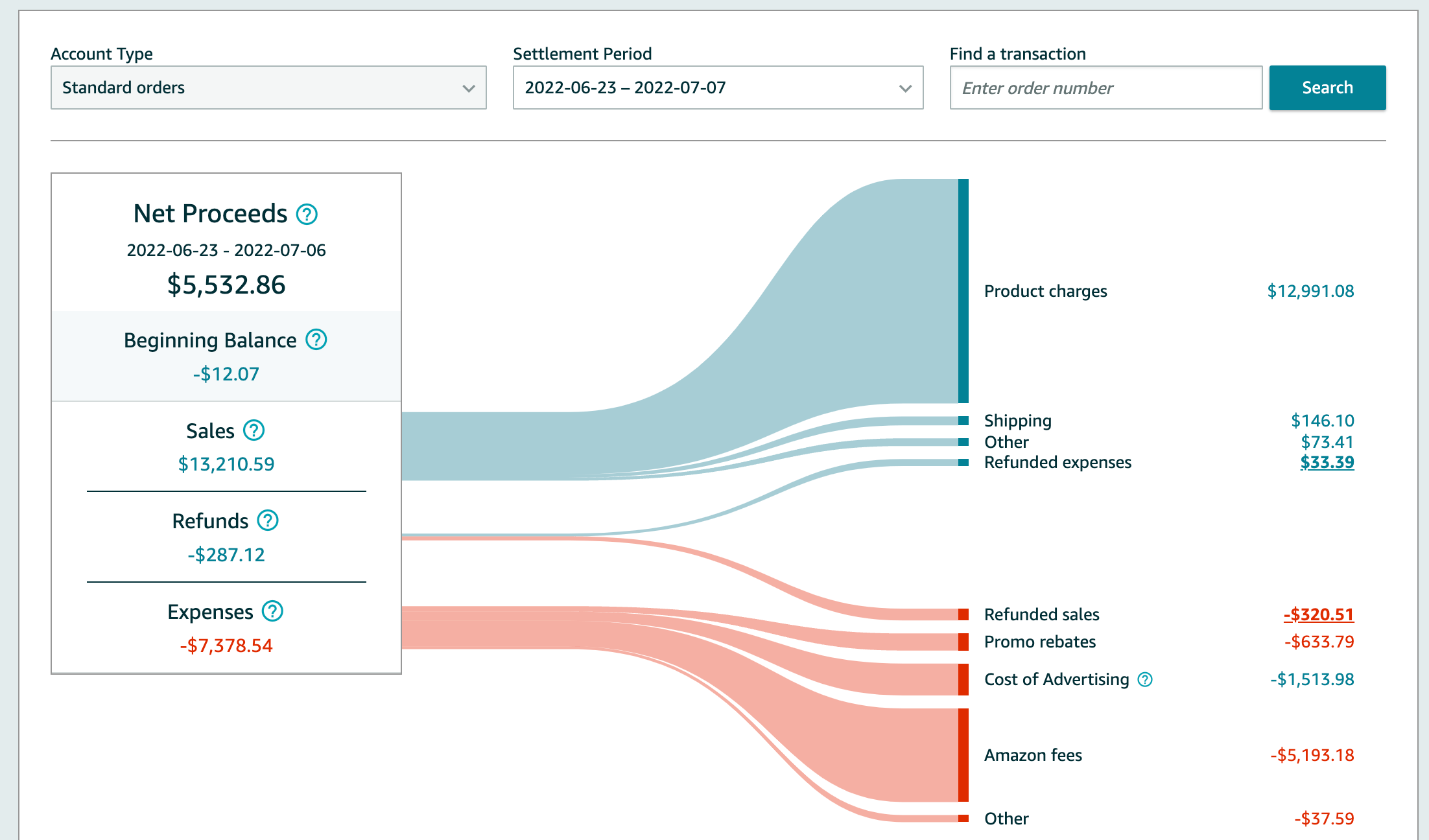

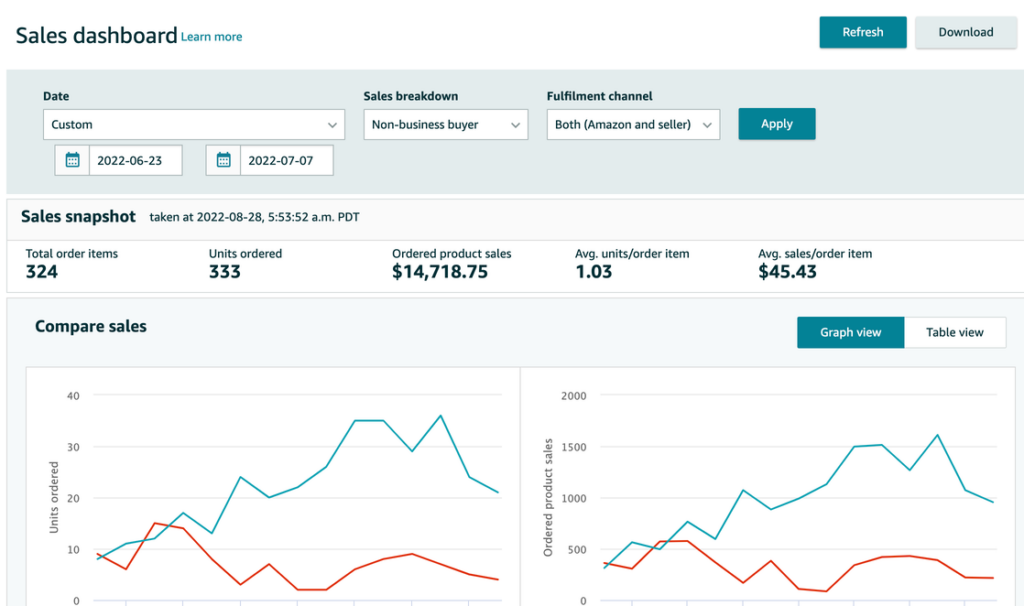

On the disbursement report, amazon charged our account for $1,5k while, in reality, for the selected period, we spent $1,9k.

So, how does Amazon charge you for your PPC campaigns?

Amazon has a threshold called a “credit ladder.” You get charged until you reach the threshold of $50, $150, $200, $350, and the maximum of $500. Each time you reach a new level in the “credit ladder” and your credit limit changes, your account will be charged. If you use a credit card to pay for advertising costs, you will not see the “Cost of Advertising” charge on your disbursement report.

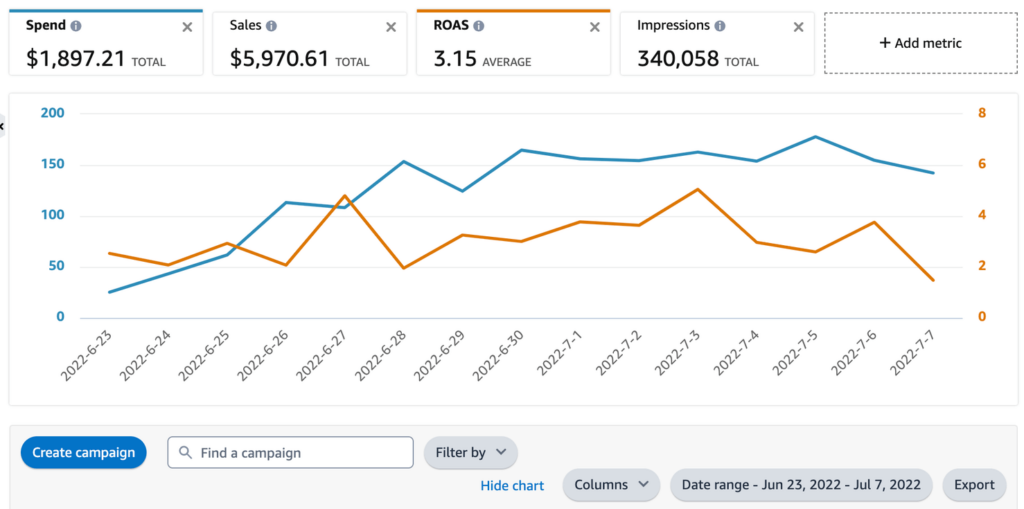

Sales Data Business Reports Sales vs Disbursement Report Sales

What about business reports? They also use the accrual basis method. They show sales when the customer makes a purchase.

On the disbursement report, amazon paid us $13k for posted sales, while for the selected period, we sold $14,7k worth of sales.

Why do your amazon sales seem different?

Disbursement sales are orders shipped for a selected period, while Business Reports include orders placed during a selected time period, regardless of settlement status.

To sum up, Cash Basis is for Cash Flow. Accrual Basis is for Profit Analytics

Now you see that using the cash basis method can give you a completely different picture of your business. That is why we recommend constantly tracking and calculating your sales and ad spending on an accrual basis.

How does this affect your performance KPIs?

It completely changes business performance metrics as well as your true profit calculation. Let’s make a few examples.

TACOS

- Your TACoS is 12.8% based on the accrual basis method (actual sales velocity and advertising spend)

- Your TACoS is 11.6% based on the cash basis method (disbursements report)

Organic Sales %

- Your organic sales are 54% based on disbursement reports (cash)

- Your organic sales are 59% based on business reports (accrual)

It will affect any KPI and, of course, profitability calculation.

Automated Solution

The problem with using the accrual basis method for amazon seller analytics is that it requires downloading about ten different reports from an amazon account and properly combining them. It would help if you tracked all of these factors to get an accurate picture of your business’s profitability.

Furthermore, the best way to do that is to use the Amazon Profit Analytics tool.

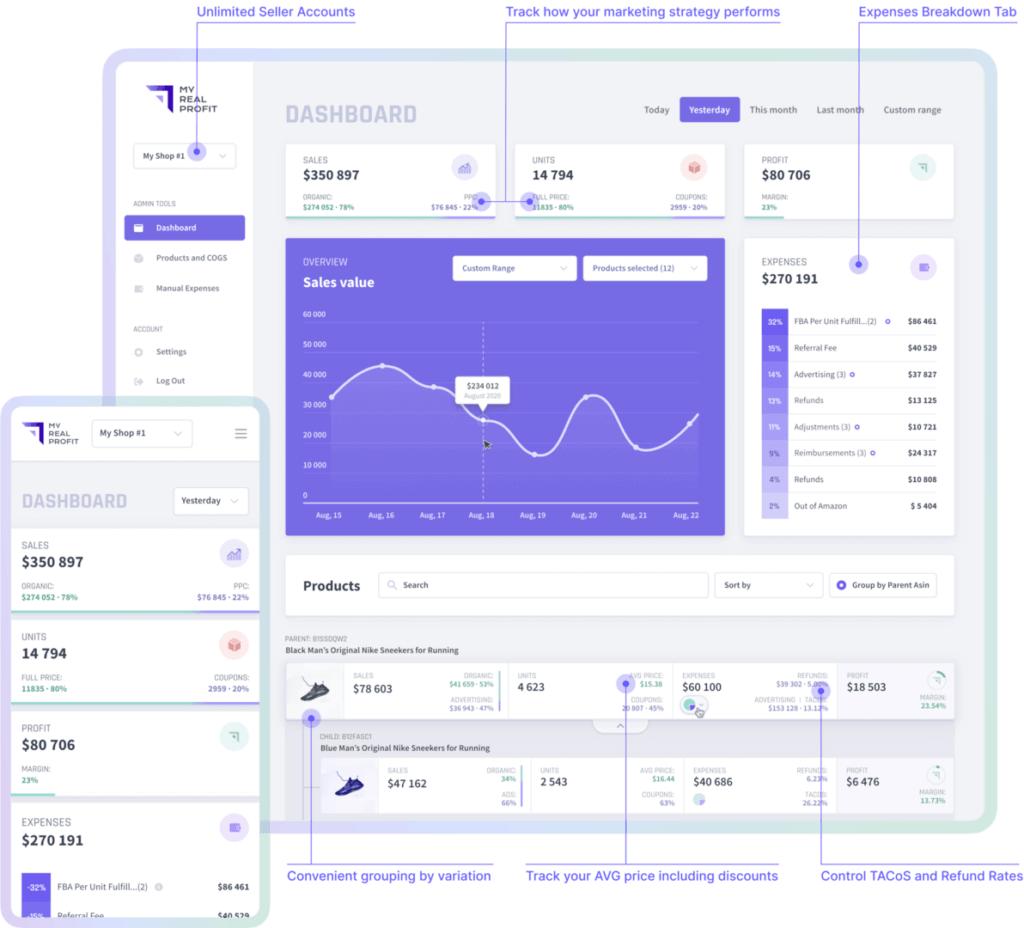

It allows you to monitor all your amazon revenue and expenses in one place and track your business’s true profitability at a glance. If you want to save time and get accurate profit reports, we recommend using My Real Profit.

By using My Real Profit, you can get accrual profit analytics in just a few clicks. It will automatically take all your data safe from amazon and create a dashboard with profit data and a product dashboard with detailed information on your expenses metrics and profit margins. You can connect unlimited amazon accounts and see the full picture of your business on 1 page.

My Real Profit also does all the inventory management calculations for your Cost of Goods sold calculations, such as sellable returns or amazon reimbursements (Warehouse lost/damaged, etc.). It is a must-have for tracking your amazon product sales and profit with not having estimated profit but amazon net profit data on one page.

Schedule a call for a demo: LINK TO SCHEDULE A DEMO

Sign up for a free trial using the link below: LINK TO START A FREE TRIAL