In the Amazon advertising ecosystem, keyword strategy isn’t just about targeting the right terms – it’s about knowing when to target them, how to group them, and where to cut inefficient spend.

This guide breaks down a structured approach to keyword strategy based on the Amazon Keywords Strategy Sheet by My Real Profit. The framework focuses on how to categorize keywords, where to find the best ones, and how to make informed decisions about branded and competitor terms.

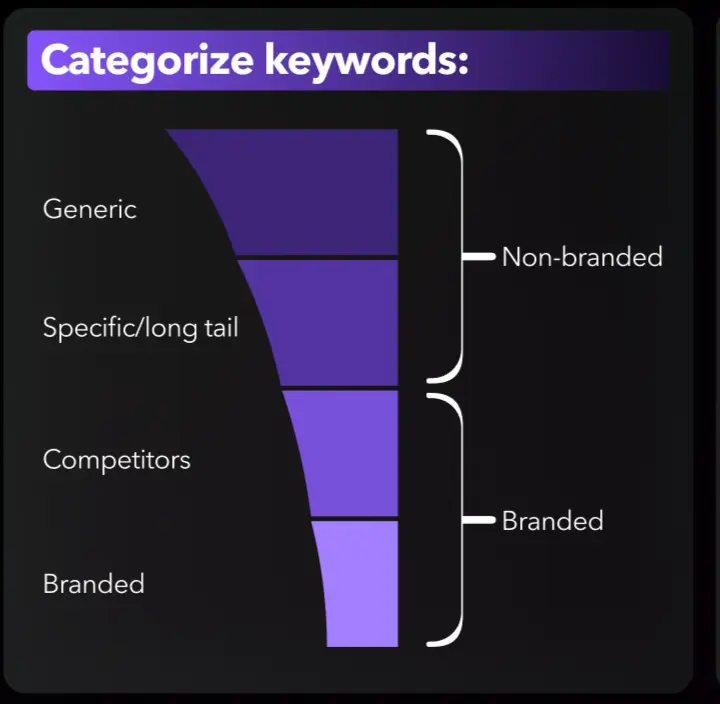

Keyword Categorization:

The keywords are broken down into four categories, each representing a different level of purchase intent and brand awareness:

- Generic

- Specific/long-tail

- Competitor-branded

- Your own branded

To make this even clearer, these four types are grouped into two main buckets: non-branded and branded. This distinction is critical when deciding how much to bid, which match type to use, and whether to prioritize a keyword at all.

Non-Branded Keywords

These are keywords that do not include any brand name. They are typically used by shoppers who are still in the discovery phase of the customer journey. They’re open to options, haven’t decided on a brand, and are likely to compare multiple listings.

Examples:

Generic: “wireless earbuds”, “kitchen knife set”, “running shoes”

Specific/long-tail: “bluetooth earbuds with noise cancelling”, “ceramic kitchen knife set with holder”, “black running shoes for men size 11”

Why these matter:

- These keywords usually have higher search volume but more competition.

- Click-through rates (CTR) can vary depending on how closely your listing matches the shopper’s expectations.

- Cost-per-click (CPC) is often lower than branded terms, especially in long-tail variants.

- They are essential for reaching new customers and increasing top-of-funnel visibility.

- However, success with non-branded terms depends on how well your listing aligns with shopper expectations. Product images, titles, reviews, and pricing all play a critical role here.

- If your product doesn’t match the intent behind the keyword — even if it ranks well — the conversion will be poor and your ACoS will spike.

Branded Keywords

These are keywords that do include a brand name — either yours or your competitor’s. They represent high commercial intent. Shoppers searching for branded terms typically already know what they want or are at least familiar with a particular brand.

Branded keywords are broken into two subtypes:

- Your own branded terms

Example: “Acme Earbuds”

This means customers are actively looking for your brand. It’s a strong indicator of brand awareness and repeat purchase behavior.

- Competitor-branded terms

Example: “Beats earbuds”

These keywords suggest that the shopper has a different brand in mind — and you’re trying to intercept that traffic.

Why these matter:

- Branded terms usually have very high conversion rates, because the shopper already has intent to buy that specific brand.

- However, your own branded terms can result in wasted spend if you’re already winning the sale organically.

- Competitor-branded terms are risky. You’ll pay a premium for clicks, and the conversion rates are often much lower unless you offer a clear reason to switch (better price, better reviews, unique features).

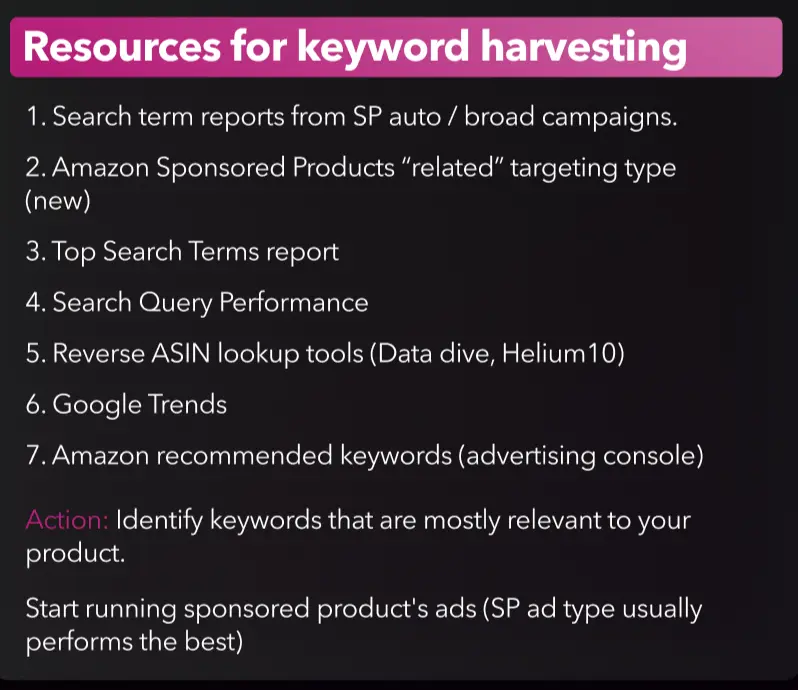

Resources for Keyword Harvesting

Amazon sellers often struggle with where to find relevant, high-performing keywords. These seven sources are your core harvesting tools:

1. Search Term Reports from Sponsored Products Auto or Broad Campaigns

These reports are one of the most underutilized sources of keyword intelligence. They show you exactly what search terms customers typed in before clicking and purchasing your product.

- Use case: Set up low-budget auto or broad campaigns specifically for discovery.

- Let Amazon explore for you — then check the reports after 1–2 weeks.

- Pull out high-converting search terms and move them into exact match campaigns with stronger bids.

2. Amazon Sponsored Products “Related” Targeting Type (New)

This relatively new feature allows you to target keywords that Amazon’s own algorithm considers “related” to your product. These are often long-tail or adjacent search terms you wouldn’t think of manually.

- Use case: Great for product discovery and finding missed keyword opportunities.

- Amazon uses internal data across search history, browsing behavior, and conversions to surface related terms.

3. Top Search Terms Report (Brand Analytics)

This report shows the most searched-for terms on Amazon, ranked by popularity and tied to specific ASINs that shoppers clicked and purchased from.

- Use case: Competitive benchmarking. You can see which products are winning for top keywords in your category.

- You also get access to the Click Share and Conversion Share, which help you understand how dominant a brand or listing is for a particular search term.

Even if you’re not in the top 3 clicked ASINs yet, knowing who is — and what keywords they’re ranking for — gives you a roadmap for content optimization and ad targeting.

4. Search Query Performance (SQP)

This is one of the most powerful, brand-specific tools Amazon has released.

It shows you how shoppers engage with your brand at every stage of the search funnel:

- Search Impressions

- Product Views

- Add-to-Carts

- Purchases

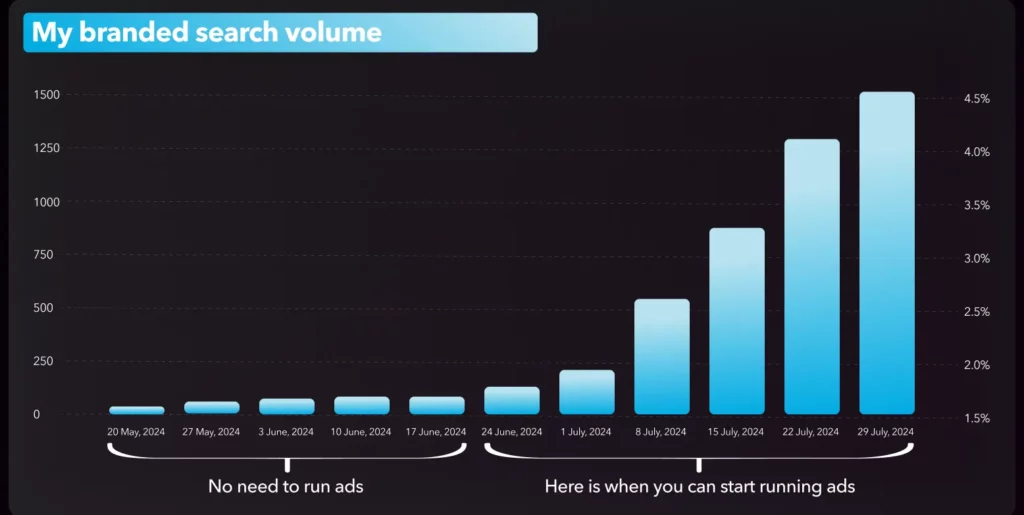

It also tells you the branded vs non-branded keyword mix, and gives you visibility into your purchase share for branded terms — a key signal when deciding whether to run defensive ads.

- Use case: Use SQP weekly to monitor your branded keyword growth. If branded search volume is rising but purchase share is below 90%, you may need to defend your brand with ads.

- Also ideal for identifying search terms where you’re getting views but not conversions — a signal to improve listing content or pricing.

5. Reverse ASIN Lookup Tools (e.g., Helium10, Data Dive)

These tools allow you to plug in a competitor’s ASIN and see which keywords they rank for — both organically and through ads.

- Use case: Competitive intelligence. See which keywords your top competitors are bidding on and which they are winning organically.

- Ideal for discovering high-converting keywords that haven’t yet been saturated by your brand.

Most of these tools also provide data on keyword difficulty, estimated search volume, and historical trends, helping you prioritize what’s worth targeting.

6. Google Trends

While not Amazon-specific, Google Trends gives you visibility into seasonality, emerging trends, and regional demand patterns for product-related terms.

- Use case: Identify rising search topics before they peak on Amazon.

- Helps validate whether a keyword is experiencing short-term hype or sustained growth.

This is especially helpful if you’re planning seasonal promotions or launching a new product. If a keyword shows strong momentum on Google, it’s likely that interest will spill over into Amazon shortly.

7. Amazon Recommended Keywords (within the Advertising Console)

When creating a new ad group, Amazon provides auto-suggested keywords based on:

- Your product listing content

- Customer behavior

- Historical performance (if available)

These are not random — they are based on actual data from Amazon’s vast ecosystem.

- Use case: Ideal for launching new campaigns or filling in gaps when your keyword list feels limited.

- Always review and filter for relevance. Not all recommended terms are worth bidding on.

Branded Search Terms

Branded search terms can be one of the most powerful levers in your keyword strategy — but they’re also one of the easiest ways to waste ad spend if not managed properly.

Branded keywords may seem like an easy win — they often bring high CTR and conversion rates. But if you’re already ranking organically, aggressive bidding can waste budget and inflate performance metrics. It’s important to separate smart defense from unnecessary spend.

Let’s break it down by branded keyword type:

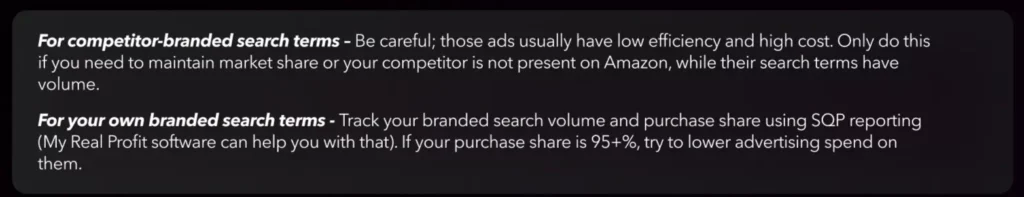

Competitor-Branded Terms

These are keywords that contain a competing brand’s name — for example, a seller of earbuds bidding on terms like “Beats headphones” or “Sony earbuds.”

The Risk:

- High CPCs: Amazon knows these keywords are valuable — especially to competitors — and prices them accordingly.

- Low conversion rates: Shoppers searching for a specific brand name usually have a strong preference. If your product doesn’t clearly outperform or offer a unique advantage, they’ll scroll past.

- Poor ad efficiency: These campaigns often look attractive in theory but underdeliver in real performance metrics like ROAS and TACoS.

When to Use:

- Your competitor is out of stock: If their listing is temporarily unavailable or has a suppressed Buy Box, it can be a prime moment to capture redirected demand.

- Their listing quality has dropped: Low reviews, bad images, or pricing misalignment could open a window to attract switchers.

- You have a direct competitive advantage: If you can clearly demonstrate better value (e.g. same features at a lower price), then conquesting may be viable.

How to Approach:

- Start with small daily budgets and tight targeting (exact match only).

- Monitor your ACoS and conversion rate daily.

- If performance stays weak beyond 1–2 weeks, cut the campaign or pivot to a different angle (e.g. targeting their category instead of their name).

Your Own Branded Terms

These are keywords that include your brand name — for example, “Acme protein powder” or “Acme travel backpack.” They’re used by customers who already know your brand and are often further down the buying funnel.

The Opportunity:

- High intent: These shoppers are not browsing — they’re looking for you.

- Strong conversion rates: Most of the time, branded terms convert at 2x–3x the rate of generic ones.

- Brand defense: Running ads on your own terms can prevent competitors from bidding above your organic listing and intercepting your customers.

But here’s the catch — if you’re already ranking #1 organically for a branded term and have no competing ads showing up above, there’s little reason to pay for that click.

Use branded campaigns to protect your real estate, measure brand growth, and retarget shoppers, but avoid overspending when the organic result is already doing the job.

When Branded Ads Do Make Sense

Here are scenarios where running ads on your own branded terms is justified:

- During a product launch: You want to capture all branded traffic and reinforce awareness.

- Competitors are bidding on your terms: You need to push them down and keep your listing dominant.

- Your organic placement isn’t #1: Ads can help you reclaim top-of-page visibility.

- You’re promoting a specific bundle, variation, or limited-time deal: Branded ads can point shoppers directly to the right listing.

- You’re retargeting past customers with DSP: Branded search terms can be a great complement to retargeting campaigns.

Conclusion

Too many Amazon sellers waste budget on the wrong keywords at the wrong time.

This cheat sheet a clear path to data-driven decision-making:

- Direct spend toward high-impact opportunities

- Continuously monitor key performance indicators

- Adjust campaigns based on actionable data insights

Need help tracking your branded search trends and SQP metrics automatically? My Real Profit tracks this for you.

Try My Real Profit for free and start making the most out of your Amazon data today!