If you’re an experienced Amazon seller or agency, you’ve probably seen the Search Query Performance (SQP) report in Seller Central. But here’s the reality: most sellers barely scratch the surface of what it can do.

The SQP report isn’t just a keyword list. It’s a diagnostic tool—one that reveals market dynamics, performance bottlenecks, and hidden opportunities with more clarity than any standard keyword tool.

At My Real Profit, we work with professional sellers and operators who demand precision. This article breaks down the 7 most impactful use cases of the SQP report.

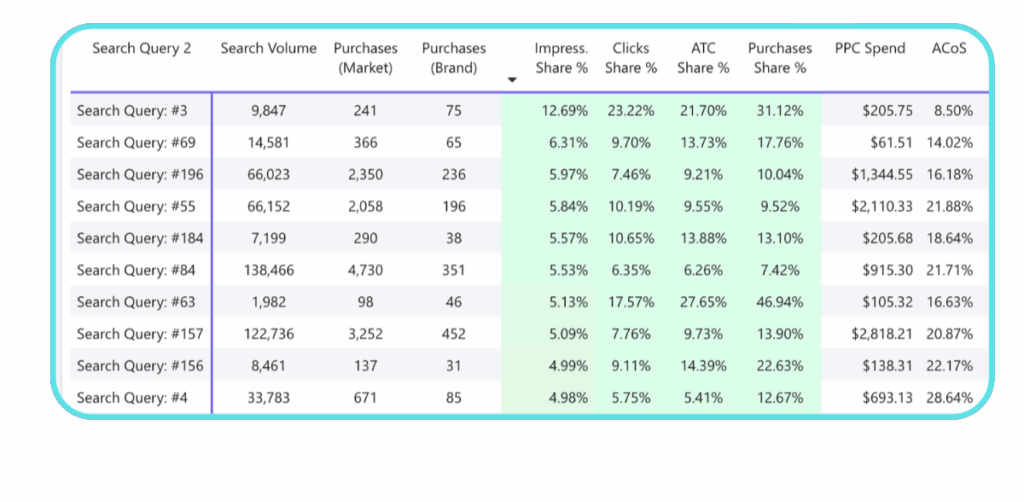

Use Case 1: Find keywords with maxed-out impression share

If your impression share for a keyword is nearing 5% with just one parent ASIN, that means you’re already at the top. You’re likely capturing most of the real estate on the SERP through a combination of organic and paid placements.

But this also means you might be:

- Cannibalizing your organic sales with too much PPC

- Over-spending on a keyword that no longer scales

What to do instead:

- Improve your content to lift CTR: At this stage, getting more impressions isn’t the problem—getting more clicks is. Review your main image, title, and bullet points with a critical eye. If they’re not driving clicks, they need to be sharper, more visually appealing, or more benefit-focused. Use version testing or creative refreshes to improve how your product stands out on the SERP.

- Adjust your price to impact CVR: When visibility is high but conversions are soft, pricing is often the bottleneck. Test small price changes (even a 5–10% reduction) to see if conversion rates increase. Especially in saturated categories, being competitively priced can have a bigger impact than spending more on ads.

- Don’t increase bids or budget unnecessarily: Your visibility is already maxed out—pushing harder with ad spend won’t create new demand. It’ll just shift conversions between organic and paid placements. In fact, increasing spend here often leads to higher ACoS without additional return.

Use Case 2: Revisit your SEO keyword strategy

One of the most common mistakes is using search volume as a proxy for performance. It’s not.

Clicks > Search Volume

Clicks show real customer interest. High search volume terms often convert poorly because they’re too broad.

SQP lets you see actual clicks per keyword. That’s the metric that matters.

What to do instead:

- Prioritize keywords with high click volume and clear buyer intent—even if the overall search volume is lower. Clicks reflect real user behavior. If people are actively clicking on your competitors for a specific keyword, that keyword has intent. On the other hand, high-volume keywords with low click activity usually indicate window shopping, vague searches, or poor fit for your product category. Focus on the terms that show users are ready to act.

- Build your SEO strategy around engagement, not vanity metrics. Too many sellers chase search volume without considering what happens after the search. A keyword that brings 50 highly engaged clicks is far more valuable than one that brings 1,000 impressions and no meaningful traffic. Optimize your listings—titles, bullets, and backend keywords—around the terms that actually drive clicks and purchases.

Use Case 3: Find growth-ready keywords for new products

Let’s say you sell blueberry-flavored supplements, but SQP shows strong keyword performance for “strawberry supplement”—and your brand isn’t showing up.

That’s not just a missed keyword. That’s a missed product line.

SQP helps you find:

- Related niches you’re not serving

- Strong-demand keywords your ASINs don’t match

What to do instead:

- Look for high-click keywords where your brand’s share is low or zero. These are clear indicators of demand that your catalog isn’t currently addressing. If a keyword is generating strong engagement but your products aren’t showing up—or are buried in results—it’s a sign you may be missing out on a profitable niche or variation.

- Validate demand before launching a variation or new product. Don’t rely on gut instinct or trend-chasing. Use the SQP report to confirm that the keyword consistently brings in clicks and purchases across the market. If that demand is stable and aligns with your brand’s capabilities, then it’s worth considering a targeted product launch to capture that opportunity.

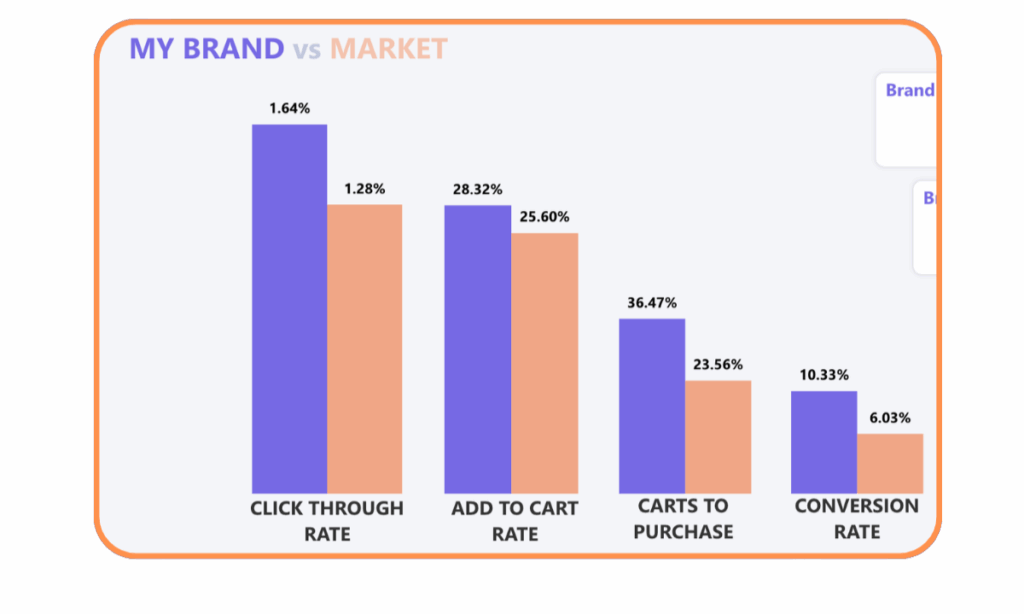

Use Case 4: Understand your keyword relevance

Most sellers optimize listings blindly. With SQP, you can actually compare:

- Your CTR vs. the market’s CTR

- Your CVR vs. the market’s CVR

If you’re pushing a keyword with poor performance:

- It might be your content (if CTR is low)

- Or your price (if CVR is low but CTR is fine)

What to do instead:

- Use keyword-level benchmarks to identify underperformance. The SQP report lets you compare your CTR (click-through rate) and CVR (conversion rate) against the market average for each keyword. If you’re falling behind, it’s a sign that your listing or pricing isn’t resonating as well as competitors for that specific term. This insight gives you a clear starting point for optimization—based on data, not guesswork.

- Fix pricing first if you’re positioned well above the market average. A common mistake is assuming low conversions are always due to content issues, when in reality, your price might simply be out of range for that keyword’s shopper profile. If your offer is significantly more expensive than the average on that search term, many customers won’t even click. Before overhauling your listing, test pricing adjustments to see if conversion rates improve.

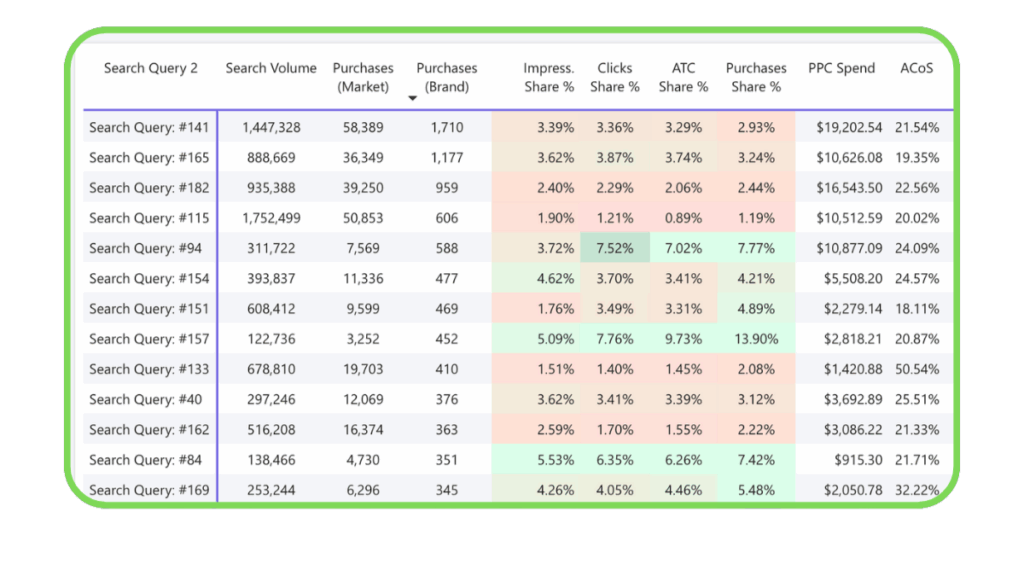

Use Case 5: Identify market share per keyword

Not all keywords contribute equally. Some keywords:

- Bring in the bulk of your revenue

- Have room to grow, while others are capped

SQP lets you see:

- Which keywords are delivering the most purchases

- What market share you hold for each one

- Use this data to prioritize both your advertising budget and listing content updates. Not all keywords deserve equal investment. Focus your spend and optimization efforts on keywords that are already showing traction but still have room to grow. This allows you to scale more efficiently, without overextending on terms that are already saturated.

- Apply realistic growth expectations based on current market share. If your brand is sitting at around 2% market share for a keyword, doubling that to 4% is a reasonable goal—especially with the right mix of SEO, PPC, and pricing adjustments. But if you’re already at 10%+, pushing to 20% often comes with diminishing returns and much higher ad costs.

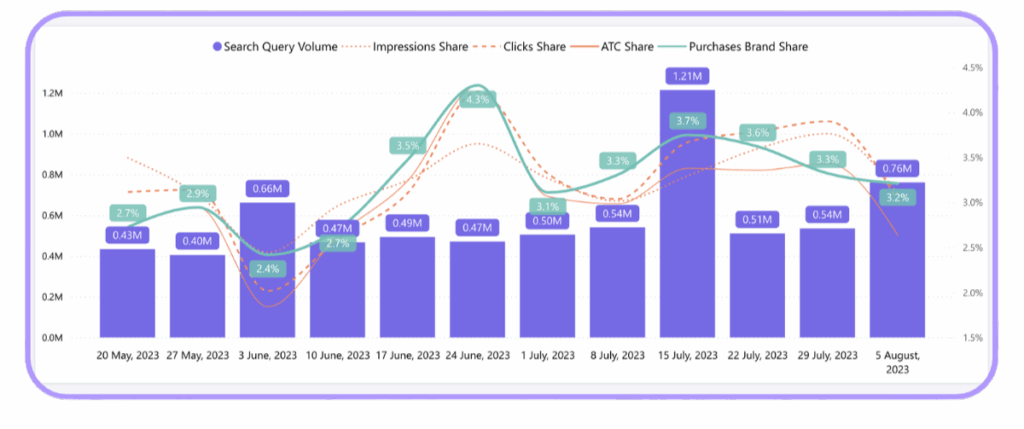

Use Case 6: Track market size changes

Your sales are down. But is the problem internal—or is the entire market shrinking?

SQP shows total keyword-level market size over time. If the whole keyword is seeing fewer purchases, the issue may not be your brand.

What to do instead:

- Track total purchases per keyword at the market level, not just your own. The SQP report shows how many total purchases occurred for a given keyword across the entire Amazon marketplace. Monitoring these totals over time helps you understand whether a dip in your brand’s sales is unique—or part of a broader trend affecting all sellers.

- Use this insight to separate brand performance from market fluctuations. If keyword-level purchases are down across the board, it’s likely a seasonal drop, trend shift, or external market factor. But if the overall market is stable and your purchases are falling, then the issue is likely internal—listing, pricing, availability, or competitive pressure.

Use Case 7: Track your market share

Market share can be calculated using either:

- Purchases or

- Clicks

But clicks are more reliable for decision-making.

Purchases include noise—24-hour attribution, halo effects, or variation-level attribution gaps. Clicks show pure interest.

What to do instead:

- Use click-based market share to measure your true visibility and performance shifts over time. Clicks reflect how often shoppers are actually engaging with your listings after a search—giving you a cleaner signal of brand awareness and SERP presence. Unlike purchases, clicks aren’t distorted by attribution delays, price sensitivity, or product availability.

- Rely on clicks to identify early changes in performance. Because clicks occur at the top of the funnel, they’re often the first indicator that something’s off—whether it’s declining interest, poor thumbnail appeal, or shifting competition. Waiting for purchase data alone means reacting too late.

A Few Tricky Attribution Rules

To get the most out of SQP, you need to understand how data is attributed. Here are some of those:

- Impressions are inflated on desktop (50+ per search) vs. mobile (usually ~15).

- If a shopper clicks on variation A but buys variation B, the click won’t be tied to the purchase in SQP.

- Cart adds and purchases may mislead if you don’t account for variation-level behavior.

Pro tip: Track clicks first. It’s the cleanest signal in the funnel.

Conclusion

Most sellers treat SQP as a keyword tool.

But real Amazon sellers use it to:

- Detect saturation

- Guide product roadmap

- Fix content and pricing issues

- Isolate market vs. brand trends

- Benchmark performance keyword-by-keyword

If you’re only looking at impressions or purchases, you’re missing the most accurate funnel metric: clicks.

If you would like to get an automated Search Query Performance analytics tool, you can try My Real Profit.

Try My Real Profit for free and start making the most out of your Amazon data today!