Understanding what drives consumer decisions is no longer optional – it’s a strategic necessity.

For Amazon brands operating in increasingly saturated and competitive markets, aligning every part of your strategy with actual buyer behavior is fundamental to long-term success. While creative assets, ad spend, and keyword targeting often take center stage, many conversion losses occur much earlier – at the moment a shopper is deciding whether they trust your product enough to click “Buy Now.”

This article distills insights from peer-reviewed research and market studies- sourced from platforms like ResearchGate, BrightLocal, and Statista – to uncover the real psychological and behavioral factors that influence buying decisions on Amazon. The goal: to help you ground your marketing and listing strategies in evidence-based data, not assumptions.

What Really Influences Buying Behavior on Amazon

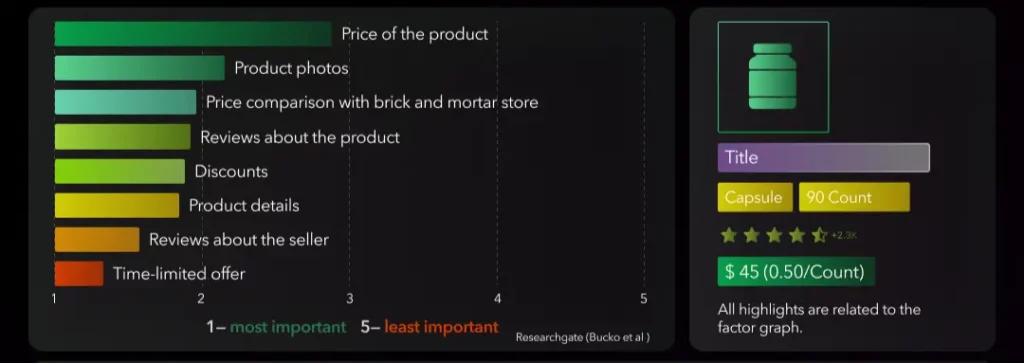

To understand how buyers make decisions on Amazon, we need to look at the hierarchy of priorities that guide their attention and actions. Based on consolidated research findings, here’s how consumers typically rank the factors influencing their purchase decisions (1 = most important; 8 = least):

- Price of the product – Buyers often make snap decisions based on whether the price feels fair or competitive compared to similar options.

- Product photos – High-quality images help customers quickly understand what the product looks like, how it works, and whether it fits their needs.

- Price comparison with brick-and-mortar – Shoppers frequently compare online prices with what they expect to pay in physical stores to determine if the deal is worthwhile.

- Reviews about the product – Social proof in the form of ratings and customer feedback significantly impacts trust and perceived product reliability.

- Discounts – Temporary price reductions or coupons can trigger urgency and increase perceived value, making buyers more likely to act.

- Product details – Clear, well-structured product information helps customers confirm features, sizing, and compatibility before purchasing.

- Reviews about the seller – A seller’s reputation—reflected in their ratings and reviews—can influence trust, especially for higher-value or niche items.

- Time-limited offers – Flash deals and countdowns create a sense of urgency, encouraging impulsive buying decisions to avoid missing out.

The conclusion is clear: price and visuals are the primary drivers of initial interest. These elements form a consumer’s first impression and determine whether they’ll even consider learning more about the product. High-quality images help shoppers visualize the item, understand its use, and assess its value at a glance. Meanwhile, competitive pricing acts as a gatekeeper – if it feels too high compared to alternatives, they’ll scroll past without a second thought.

However, trust-building elements like product reviews, seller reputation, and detailed content still play a crucial role further down the funnel. They help reassure buyers that the product will meet expectations and that the seller is credible, especially for higher-priced items or less familiar brands.

Implication: If your pricing is off, you’re out of the game. If your product imagery fails to convey value or clarity, you won’t get the click. And even if you’ve done both right – without strong reviews and social proof, your chances of conversion are still at risk.

The Psychology Behind the Product Page

Most Amazon sellers invest heavily in A+ Content, videos, and branded storefronts. These enhancements do matter—but only after the shopper has chosen to engage with your listing. Before that click happens, more fundamental factors determine whether you’re even in the running. Let’s walk through what truly influences buyer behavior before A+ content ever gets seen.

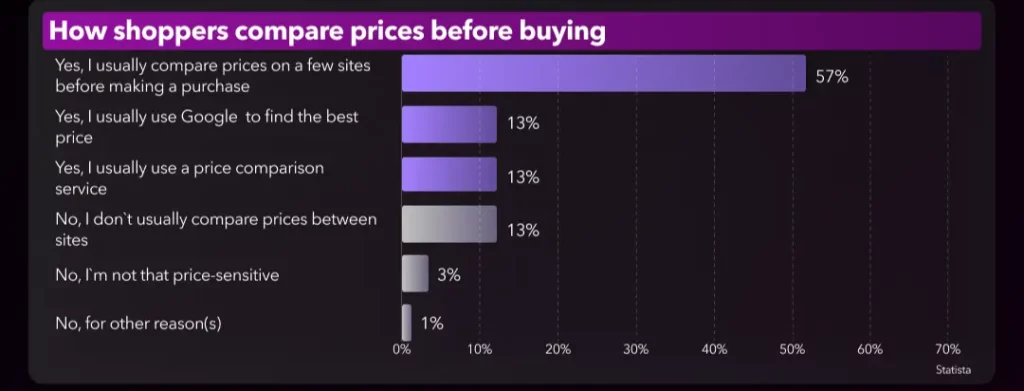

Price remains the most powerful decision driver in e-commerce, and Amazon is no exception. According to recent studies, 57% of buyers compare prices across multiple websites before committing to a purchase.

- 13% of shoppers use Google to actively search for better deals.

- Another 13% rely on specialized price comparison tools.

- Only 13% say they don’t compare prices at all—which means 87% of shoppers are checking.

What does this mean for your strategy?

Your pricing doesn’t just compete on Amazon—it’s being silently evaluated across platforms and channels, including brick-and-mortar. Even if your product is superior, if the price feels off, most customers won’t bother exploring further.

Make sure your price positioning is consistent, rationalized, and adjusted based on what customers see outside the Amazon ecosystem. Especially for commoditized or non-unique products, even a $1–2 difference can shift the sale to a competitor.

Photos Are the Second Most Powerful Driver

When it comes to influencing purchase behavior, images are more impactful than discounts, bullet points, and even reviews. Why? Because visuals speak instantly—before a shopper reads a single word.

- Main Image = The Hook: It determines whether the shopper clicks or keeps scrolling. A blurry or poorly cropped image can instantly kill interest.

- Secondary Images = Objection Handling: Use these to answer common questions, showcase features, and highlight differentiators (e.g., size, usage, texture, packaging).

- Lifestyle Photos = Aspirational Trigger: These create emotional resonance, helping the buyer imagine the product in their daily life or ideal future.

If your click-through rate (CTR) is under 1%, don’t start by increasing your bids—start by reviewing your images. Low CTR is often a sign that the visuals aren’t selling the product effectively enough to earn the click in the first place.

The Role of Reviews in Buyer Decisions

Here’s where things get interesting. The data shows reviews aren’t just helpful — they’re often the final validation layer before a customer commits.

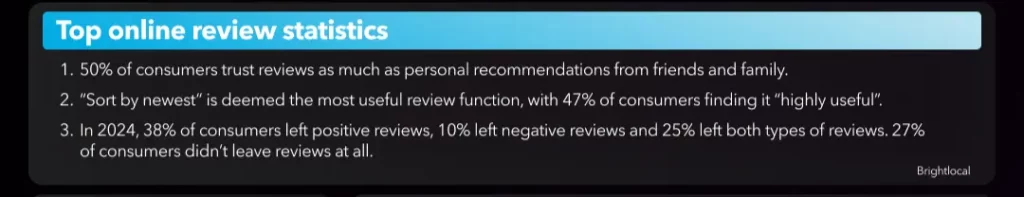

Consumer Review Behavior (BrightLocal, 2024):

- 50% of shoppers trust reviews as much as personal recommendations.

- 47% find “Sort by Newest” the most useful review filter.

- 38% leave positive reviews.

- 10% leave negative reviews.

- 27% don’t leave any reviews.

Most customers read – but don’t write. And when they do, they care more about recency than quantity.

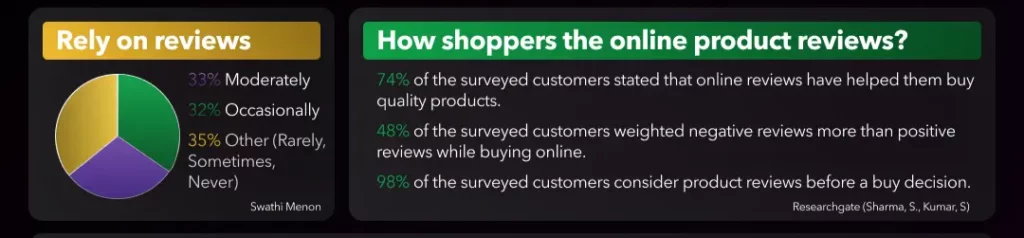

How Shoppers Use Reviews (ResearchGate):

- 74% say online reviews help them identify quality products.

- 48% say they weigh negative reviews more than positive ones.

- 98% check reviews before buying.

Negative reviews can override good impressions. One bad bullet point, photo, or shipping delay mentioned in multiple reviews can kill conversion.

Reviews vs. Seller Trust

Not all reviews are created equal—and knowing which ones matter more can help you prioritize what to fix first.

Research shows that product reviews have a far greater influence on purchasing behavior than seller reviews. While both are technically visible to shoppers, most customers focus on the product experience rather than the identity of the seller.

Why Product Reviews Matter More:

- Buyers evaluate the product, not the store. Especially on Amazon, customers assume the platform protects them—so they judge the item itself, not the seller.

- Volume and recency signal credibility. Shoppers tend to trust products with a large number of recent, high-quality reviews.

- Reviews answer questions before they’re asked. Good reviews (and even bad ones) help buyers anticipate product fit, quality, and use cases.

When Seller Reviews Actually Matter:

- FBM (Fulfilled by Merchant) listings where delivery, return policy, and communication are directly handled by the seller.

- High-ticket items where the perceived risk is higher.

- First-time purchases from unknown brands where every trust signal counts.

Time-Limited Offers: Overused and Underperforming

While commonly used across e-commerce, urgency tactics rank dead last in terms of what actually influences Amazon buyers.

- “Only X left in stock” and “Deal ends in 24 hours” are often seen as gimmicks, especially when overused.

- Consumers have grown immune to false scarcity—they recognize manufactured urgency and are less likely to respond.

- Without strong reviews and value, urgency tactics fall flat and may even reduce trust.

Key Insight: If you’re relying on urgency to drive sales, it’s probably masking a deeper issue—like weak reviews, unclear value, or pricing that doesn’t hold up.

Strategy Implications for Amazon Sellers

The insights from this data aren’t just interesting—they’re immediately actionable for Amazon brands looking to improve performance without guesswork.

Below are four key takeaways every seller should implement based on buyer behavior trends:

1. Split Testing Should Prioritize Price & Photos

If your listing is getting healthy traffic but not converting, the issue is likely not visibility—but perception. Price and images are your first impression.

- Run A/B tests on your main image (hero image) using tools like Manage Your Experiments or external platforms to evaluate click-through rate (CTR).

- Test multiple price points across different timeframes to identify your highest-converting threshold—especially if your market is commoditized.

- Analyze keyword performance tied to pricing intent, including terms like “cheap,” “affordable,” “budget,” “best value,” or “deal”—and ensure your listing is indexed and ad-targeted accordingly.

Tip: Small price or image changes often yield greater ROI than pouring more budget into ads.

2. Double Down on Review Acquisition

Product reviews are among the most powerful trust-building tools on Amazon—and the recency of reviews often outweighs the sheer volume.

- Automate post-purchase review requests using Amazon’s Request a Review button or third-party software that complies with TOS.

- Use product inserts (compliant with Amazon’s guidelines) to encourage customers to share genuine feedback.

- Focus on earning authentic reviews, not just “5-star” praise. Real, balanced reviews are more credible and often more persuasive.

Tip: Don’t let your review section go stale—keep review flow consistent to reflect your current product quality and service.

3. Control Your Negative Narrative

Negative reviews are inevitable—but how you respond and adapt matters more than trying to prevent them altogether.

- Identify recurring complaints in reviews or returns and directly address them in your listing copy or FAQ section.

- Update your A+ content and secondary images to proactively clarify expectations or common concerns (e.g., size, material, how to use).

- If issues point to logistics or quality (e.g., damaged on arrival, confusing packaging), revise your packaging design or shipping timelines accordingly.

Tip: Transparency builds trust—use your listing to answer objections before they show up in a 2-star review.

4. Don’t Over-Rely on Discounts and Timers

Urgency and scarcity tactics have lost much of their effectiveness. Modern consumers see through countdown timers and “only 3 left” banners unless there’s real value behind them.

- Instead of racing to the bottom with discounts, offer bundled value (e.g., complementary products, how-to guides, better packaging).

- Position your product based on benefits and outcomes: What does it help the buyer achieve or solve?

- Use promotions strategically—as part of a larger campaign or launch, not as a permanent crutch.

Tip: If your sales lift disappears the moment your deal ends, it’s a signal your core offer isn’t strong enough on its own.

Conclusion

The Amazon marketplace is built on speed and scale. But your shoppers are still human. Their behavior follows patterns. These patterns are measurable. And once you understand them, you can influence outcomes more effectively than any ad bid adjustment ever will.

If you’re not tracking:

- How reviews change conversion

- How pricing compares across competitors

- What role visuals play in your CTR

You’re not running a data-driven business — you’re guessing.

It’s time to build smarter. Need help tracking different metrics automatically? My Real Profit tracks them for you.

Try My Real Profit for free and start making the most out of your Amazon data today!