Many sellers focus on ranking, brand awareness, marketing efforts, finding new product niches, and driving more sales. These things are essential, but that’s just the tip of the iceberg.

If you want to take your Amazon business to the next level and start seeing more profits, there are a few key questions that you need answers for. Knowing those answers is essential if you hope to reach success. What net income does your business bring in? How many expenses are there per unit of product? You have to calculate the cost of goods, operating and marketing costs, refunds, etc. How much profit do they bring in?

The answers to these questions help in calculating the total amount of money earned from selling products on Amazon – gross profit, operating profit, optimizing costs, and making strategically correct decisions.

Without competent accounting of all the expenses, profits, and comprehensive analysis, Amazon sellers cannot understand their real financial performance and how the different parts of the balance sheet affect each other. Even minor unreported data can seriously affect key profit and loss metrics.

You must track essential metrics to produce the most precise profit and loss statement. In this article, we will explore those exact measurements necessary for success. We also show you how to reduce your time wasted analyzing financial performance to a minimum.

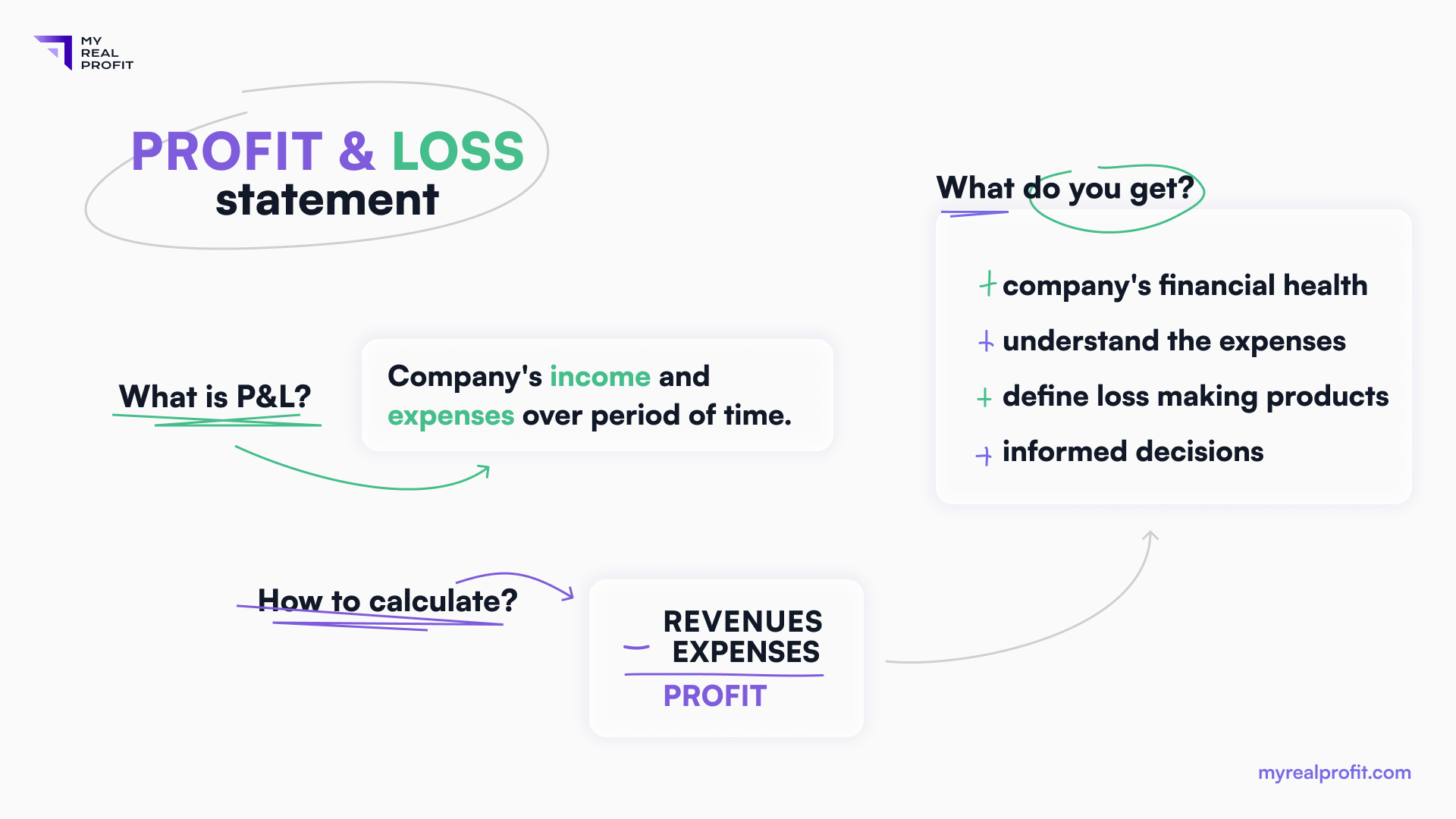

What Is a Profit and Loss Statement?

Profit and loss (or P&L) is a financial report that provides an overview of revenues, costs, and expenses of an Amazon seller’s business over a specific period. The profit and loss statement provides the most comprehensive review of a seller’s net income, generally known as the “bottom line.”

This statement calculates profits or losses by subtracting total expenses from total income. For this, you need to overview your earnings and associated costs, including the cost of goods sold, fulfillment fees, PPC cost, refunds, and other expenses.

P&L statements can help identify areas where you need to cut costs, drive revenue growth, or optimize your pricing strategy. Additionally, it can provide valuable insights into trends in sales and expenses over time.

This p&l statement report lets you make informed decisions about your business strategy tailored to increase sales and maximize profits.

But in the case of Amazon sales, everything is more complicated.

The usual profit and loss statements are insufficient for a complete picture because some costs may be left out. Amazon is unique, and so should be the P&L approach. It takes some work to be accurate in your income and loss calculations. Let’s dive into it and figure it out!

How can profits and losses be tracked?

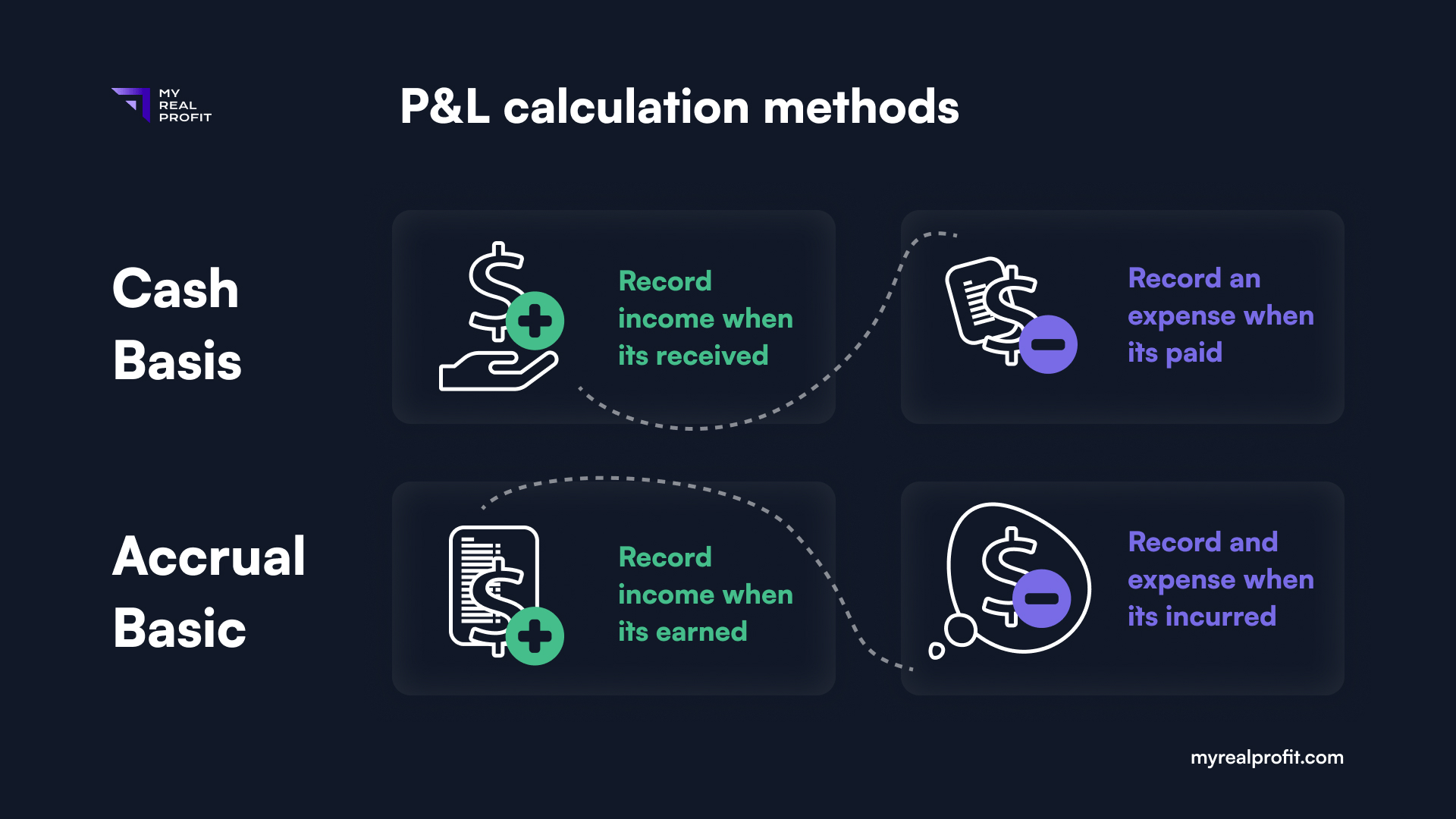

The company’s total income and expenses can be calculated using two methods:

accrual basis

cash basis.

The primary distinction between the cash and accrual methods is when transactions are recorded.

Accrual basis accounting

Sales revenue is reported on the profit and loss statements when the sale is made, often occurring before cash is received from customers. In other words, the Accrual method accounts for profits and expenses when the customer purchases your item, regardless of when Amazon pays you. This method is consistent with Generally Accepted Accounting Principles and is considered to present a more accurate picture.

Cash basis accounting

The cash flow statement records track the flow of working capital into and out of business during a period. Thus, the Cash method is based on when Amazon deposits money into your Amazon seller bank account.

Cash basis accounting cannot reveal the issues of declining organic sales or show the percentage of returns, while the accrual basis can.

The advantage of a cash report is its incredible simplicity. It can be done with one statement – a “Date Range” report, which shows your Amazon cash balance transactions. Here’s a link to a video on how to easily do p&l by cash method using just one report: How to See Your True Amazon Profit.

Accrual and Cash methods are both necessary for sellers. But today we’re going to talk about Accrual. It provides a more accurate picture of your business’s profitability and helps Amazon sellers see the connection between marketing metrics and finances, while the cash method can not.

Read the article “What is the difference between Cash and Accrual reporting for Amazon Sellers” to learn more about accounting methods.

Required Metrics to Calculate Accrual P&L for Amazon Sellers

The purpose of the Accrual report is to show all the data when a customer has made a purchase. Accrual reports can combine financial and marketing analysis, making them valuable information for sellers. In Amazon business, marketing can be a double-edged sword – it’s both the key to success and a quick way to drain profits.

To accurately estimate Amazon sellers’ profits and losses, it is essential to consider an array of metrics.

On the income side, everything is simple: Item Sales. (“All Orders” report. Link: https://sellercentral.amazon.com/reportcentral/FlatFileAllOrdersReport/1)

On the Amazon costs side, these include:

Promotions/Coupons. “All Orders” report.

Link: https://sellercentral.amazon.com/reportcentral/FlatFileAllOrdersReport/1Amazon Fees. “Fee Preview” report.

Link: https://sellercentral.amazon.com/reportcentral/ESTIMATED_FBA_FEES/1Refunds. “Date Range” report.

Link: https://sellercentral.amazon.com/payments/reports/custom/request?ref_=xx_report_ttab_dash&tbla_daterangereportstableStorage Fees. “Monthly Storage Fees” report.

Link: https://sellercentral.amazon.com/reportcentral/STORAGE_FEE_CHARGES/1Adjustments/Reimbursements/Other fees. “Date Range” report.

Link: https://sellercentral.amazon.com/payments/reports/custom/request?ref_=xx_report_ttab_dash&tbla_daterangereportstableAdvertising Cost. “Advertising Reports”

Link: https://advertising.amazon.com/reports/Sellable Returns. “FBA Customer returns” report

Link: https://sellercentral.amazon.com/reportcentral/CUSTOMER_RETURNS/0

These reports need to be properly combined in order to achieve a perfect accrual P&L report.

Besides Amazon fees, you need to include the cost of goods sold, which should include manufacturing costs, customs duties, freight costs, and delivery to FBA.

Most Amazon sellers track their profit and loss metrics using the Amazon Seller Central platform, which provides a breakdown of their sales, expenses, and profits. We recommend reviewing Amazon’s key reports every month. Above, we already mentioned these reports. Now let’s dive into each of them.

Amazon Sales (“All Orders” Report)

The “All orders” report is a crucial tool for sellers when it comes to calculating their profit and loss report. This report provides detailed information about every order, including the purchase date (which we need for the accrual basis reporting), selling price, shipping costs, and any discount/promo/coupon associated with the order. However, remember to exclude all canceled orders and non-Amazon orders.

Amazon Referral fee and Fba fulfillment fee

The “Fee Estimate” report refers to the estimated costs of selling a product on the platform, including fulfillment fee estimates and referral fees. It can help you calculate the shipping cost and referral fees per unit sold. The referral costs can vary depending on several factors, such as the product category and selling price. The FBA fulfillment fee depends on your product size and weight.

You can calculate the referral fee using the simple formula below.

Referral fee = (Sale price – Discounts) * Amazon Referral fee %.

Also, you can use a fee calculator tool to estimate your total selling fees, including referral fees, fulfillment fees, and storage costs. By estimating these fees upfront, sellers can better understand their profit margins and adjust their pricing strategies to ensure profitability.

My Real Profit provides an advanced profit calculator that uses your last 30 days’ performance to break down your real profit per unit and help you make strategic decisions using real numbers.

Advertising costs

Advertising costs can be a major factor in determining the profitability of sellers. It is important to use the various types of ads available on Amazon, then calculate the associated costs and profits for each, and analyze the data obtained. Thus, to view all advertising expenses, you need some reports:

Sponsored Products – Advertised Product report

Sponsored Display – Advertised product report

Sponsored Brands/Video – Campaigns report

Alternatively, you can take the total amount spent on PPC from your advertising console if you don’t require product-level analysis.

Date Range Report

The Date Range Report is a valuable tool for Amazon sellers who want to analyze their profits and losses over a specific period. This report provides detailed information about all transactions made within the selected date range, including sales, refunds, reimbursements, adjustments, and other fees charged by Amazon.

Through careful examination of this data, sellers can gain invaluable insights into their finances and identify areas where money may be slipping away. For example, the report can be used to help sellers recognize products with a high return rate or detect situations in which Amazon is charging them excessive fees.

FBA Storage Fee Report

The FBA Storage Fees Report provides detailed information about the storage fees charged by Amazon for storing a seller’s inventory in its fulfillment centers. Examining this data can provide sellers with invaluable insights into their storage costs relative to the revenue they generate. This information can help them make informed decisions about what products to stock and how much inventory to keep on hand at any given time. Additionally, the report allows sellers to identify any discrepancies or errors in their storage fee charges and take corrective action if needed.

However, with FBA comes the possibility of customer returns. When a customer returns any product, the seller may incur fees for return shipping and processing. Customer returns can impact net sales and, as a result, the seller’s profit and loss statement, which shows the financial performance of their business over a specific period. FBA sellers need to keep track of their returns and associated fees to assess their profit margins.

Read the article “Amazon Sellers Pay from 30% to 50% for Customer Returns from Their Own Pockets” to learn more about the true cost of returns.

For detailed analysis, we recommend reviewing the report monthly, as well as quarterly and annually.

Cost of goods sold

The cost of goods should include the manufacturing price, customs clearance, freight costs, and delivery from Amazon FBA. The final costs are often neglected and treated as a single united cost of goods in the P&L statement.

Accurate COGS are crucial when it comes to product level analysis. Make sure to calculate this number as precisely as possible. This is the most important factor in Amazon’s analysis because we make all decisions at the product level.

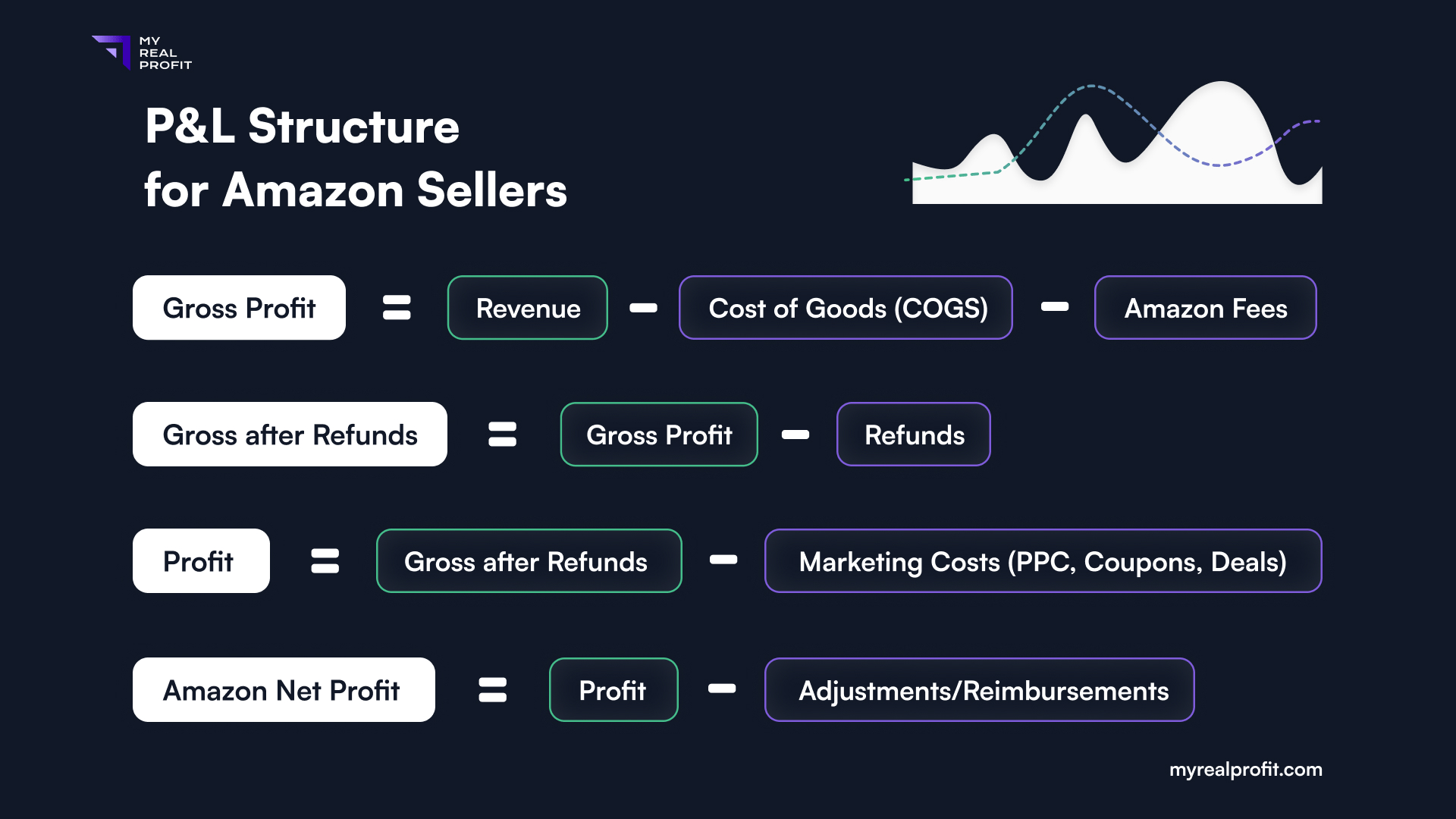

Profit and Loss Statements Structure for Amazon Seller

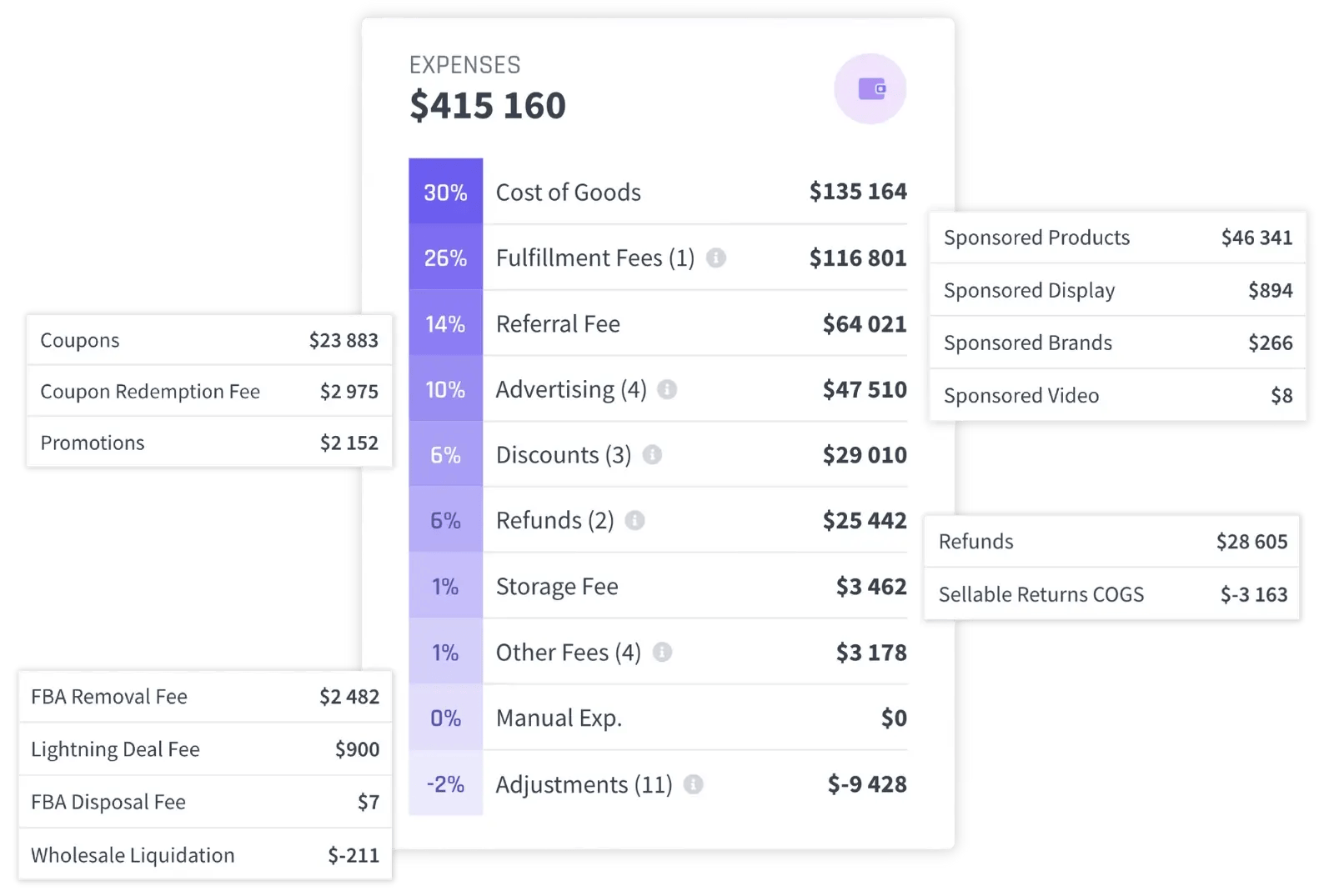

In order to scan your p&l and get insights from it, you need to group expenses in a specific way.

1) Gross Profit = Sales – COGS – Amazon fees

The cost of goods and Amazon fees will always be a part of each sale. The gross profit metric will help you identify if your pricing or unit economics is financially healthy.

2) Gross after Refunds = Gross Profit – Refunds

It helps understand how refunds impact your profits. You use this metric to calculate organic sales profit margin. Just divide: Gross after Refunds / Sales = “Organic Sales Profit Margin”

3) Profit = Gross Profit – Marketing Costs (PPC, Coupons, Deals)

4) Amazon Net Profit = Profit – Adjustments/Reimbursements

Mostly adjustments/reimbursements will increase your profit. Therefore, it is important to know your sales profit and net profit, including transactions not related to sales, such as warehouse losses, damages, or other costs like subscriptions.

While you may have gotten a good overview of your business with the profit and loss statement, the balance sheet covers the rest of the picture.

My Real Profit calculates accrual P&L statements in real-time and even more features

But why do we need so many reports just to calculate Amazon profits? Aren’t all these data supposed to be visible in payout reports from the Seller Central Account?

The problem is that the Amazon marketplace withdraws money from your account at a time that has nothing to do with concrete activity. For example, you will pay for the April storage fee in May. Amazon is charging your account for storage costs between the 7th and 15th days of the month to cover the storage fees for the previous month. Your PPC fees are charged after you spend every $500 instead what you actually spend for it.

Therefore, you can achieve a more accurate picture of the analysis only by using different reports.

My Real Profit goes even further. In addition to combining all this data, this analytics software calculates some costs in advance. For example, you can see daily storage costs because it calculates how much you will pay Amazon based on your FBA stock data. It pre-calculates Amazon fees for pending orders and allocates financial metrics with marketing performance. This approach makes it one of the most accurate financial tools for Amazon sellers.

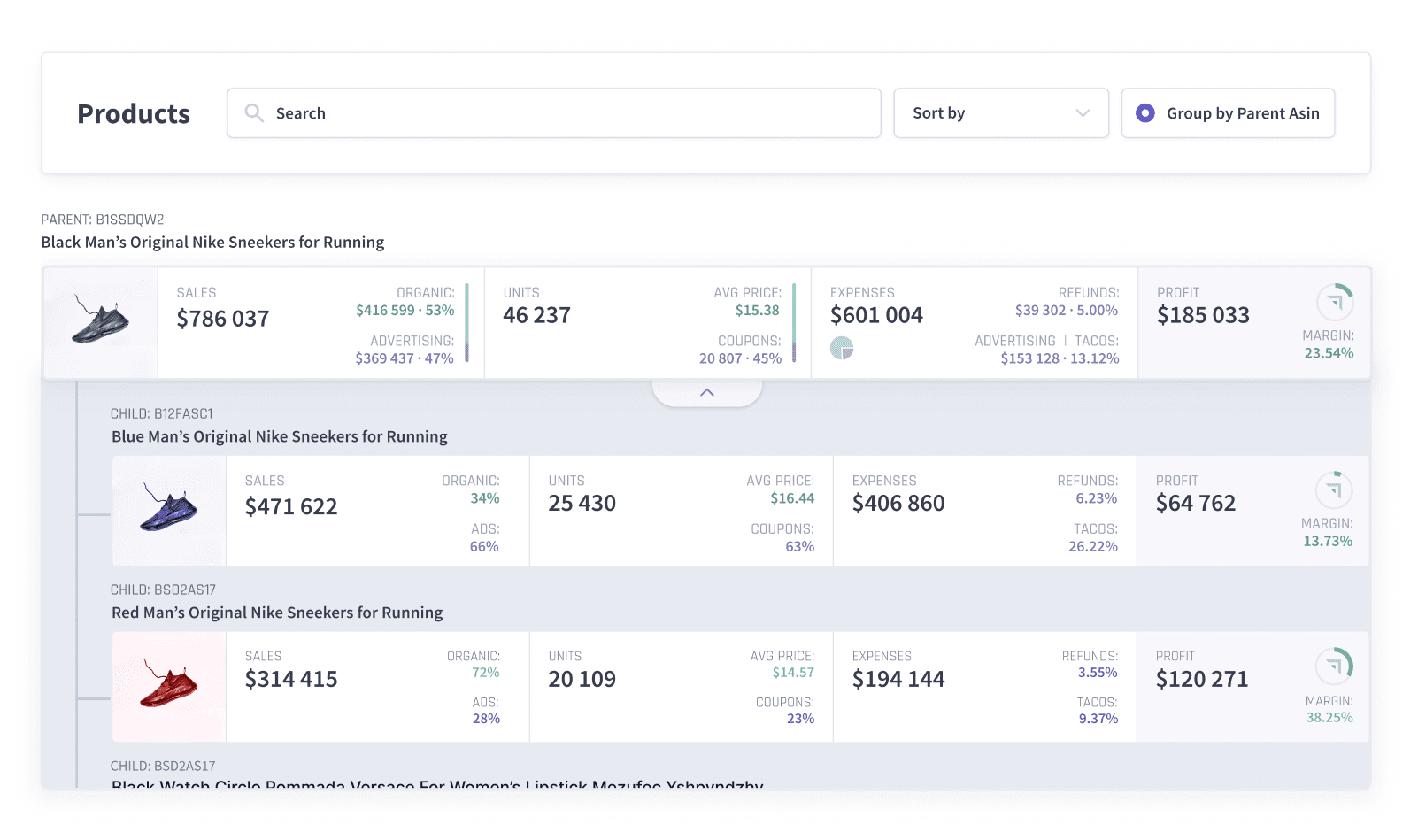

Additionally, the software collects all the data on Parent and Child ASINs which are very difficult to track using default Amazon tools.

Vertical analysis of Amazon profit and loss statements

My Real Profit conducts a detailed analysis of the return percentage, total marketing costs, and organic/advertising sales ratio so that you can accurately see how much each expenditure contributes to gross profits. By understanding this dynamic relationship between expenses and revenue, your business will be positioned for long-term success.

My Real Profit makes a detailed breakdown of all hidden expenses, showing the true picture and helping you understand why your operating profit is what it is.

Now, it doesn’t take long to compile a P&L statement with our Analytics Software. You have more available metrics and the opportunity to make informed decisions based on reliable and up-to-date information. All My Real Profit reports are updated every 30 minutes! We have put all your daily sales, marketing efforts, and financial performance information onto one page so you have a complete picture before you.

Ready to see what our demo has to offer?

Sign up for a free trial using the link below: LINK TO START A FREE TRIAL

Schedule a call for a demo: LINK TO SCHEDULE A DEMO